On Wednesday last week, a new fantasy startup investing game launched, Visionrare.

Founders Jacob Claerhout and Boris Gordts were hoping to emulate just a dose of the success of Sorare, the wildly successful fantasy football platform based on NFTs (non-fungible tokens).

More than 1k people joined the platform almost immediately, and hundreds of people put in bids on ‘VisionShares’ (fantasy stakes in startups).

But within 24 hours the money was refunded and trading stopped.

What went wrong?

Shortly after launch, it was pointed out to the founders that auctioning off fantasy shares in real companies is a tad more complex than auctioning off digital strikers and goalies to create fantasy sports squads.

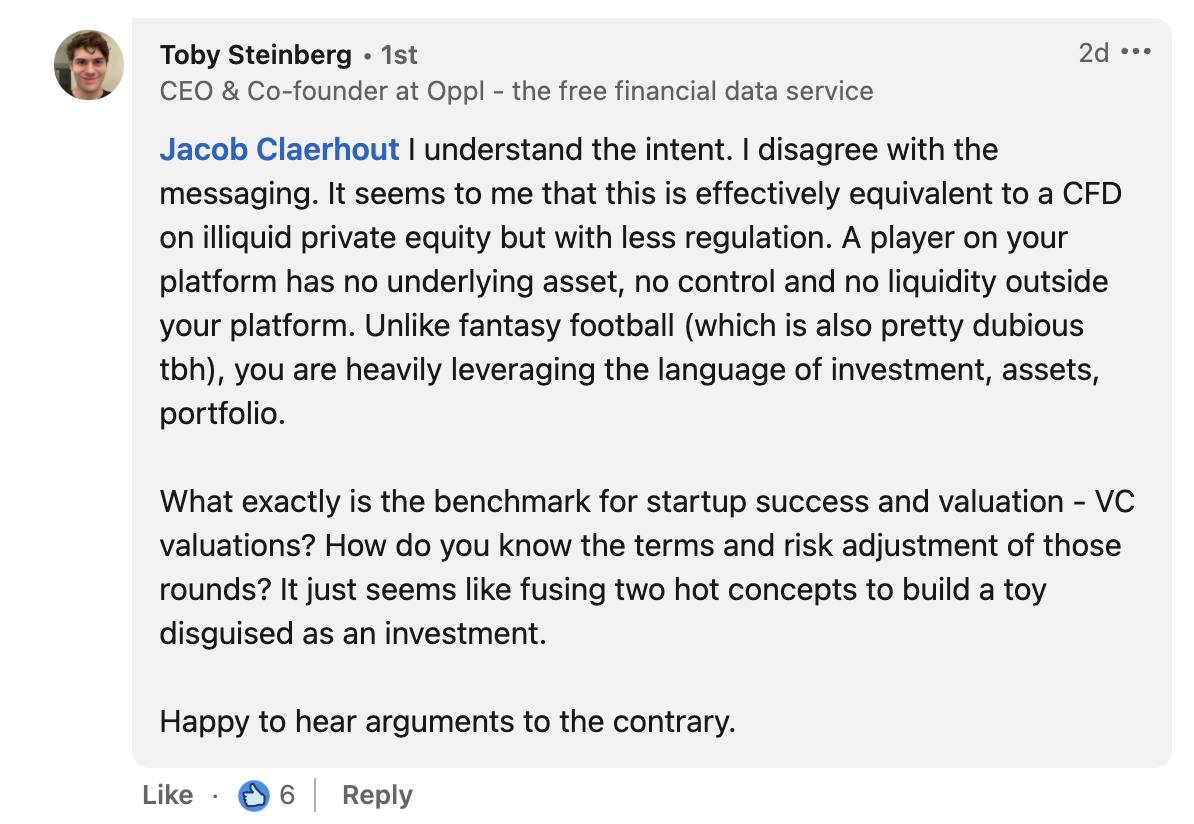

“It seems to me that this is effectively equivalent to a CFD [contract for differences] on illiquid private equity but with less regulation,” commented Toby Steinberg, founder of financial data service Oppl, on a Sifted LinkedIn post. “A player on your platform has no underlying asset, no control and no liquidity outside your platform. Unlike fantasy football (which is also pretty dubious tbh), you are heavily leveraging the language of investment, assets, portfolio.”

“Essentially they are setting up an unregulated securities market.....will have to be regulated in the long run. Plus what is to stop people insider trading and double dipping?” posted William Stormont, an investor, on the same LinkedIn thread.

By Thursday, Visionrare had announced that it was moving to a “free-to-play model” as it had “underestimated the legal complexities” involved in the product. Users who had bought shares on the platform were refunded.

Plenty of people on Twitter were not, exactly, surprised by the move — or that impressed by it.

Stumbling into securities regulation

Pre-launch, the founders were under the impression that they wouldn’t bump into regulators.

“Is this a derivative product? We’re not… we have no access to the governance of a company,” Claerhout told Sifted, before Visionrare launched. “This is a skill-based game, so regulators wouldn’t consider this gambling.”

Speaking to Sifted on Friday, the Visionrare founders added that they did “extensive research on this matter and consulted with a corporate lawyer before launching”.

“However, upon launch, we were pointed to one US case in particular, that has some undeniable resemblances to what we set out to do. Even though what we are doing is significantly different and according to us compliant, we wanted to take a step back to reassure this position, especially given the grave consequences regulators impose when they judge you breached security laws.”

Startup surprise

It wasn’t just Claerhout and Gordts who got a surprise at launch, though.

Some founders were also “initially surprised” to find their company listed on Visionrare — although nobody delisted their company from the platform.

“We have gotten dozens of requests from other people to list their companies and there are even a few founders that asked if they could invest in Visionrare,” say Claerhout and Gordts.

What’s next?

Claerhout and Gordts plan to relaunch Visionrare this Friday for anyone to play for free.

“The game will still have the same building blocks; it will still be NFT-based, it will double down on the excitement people have for early stage companies and it will reward people for finding the next unicorns.”