Returns from UK venture capital funds are almost identical to those in the US, according to a new report published by the British Business Bank.

By comparing the returns from UK and US firms over the past 17 years the report sheds doubt on the popular belief that US funds consistently outperform those in the UK.

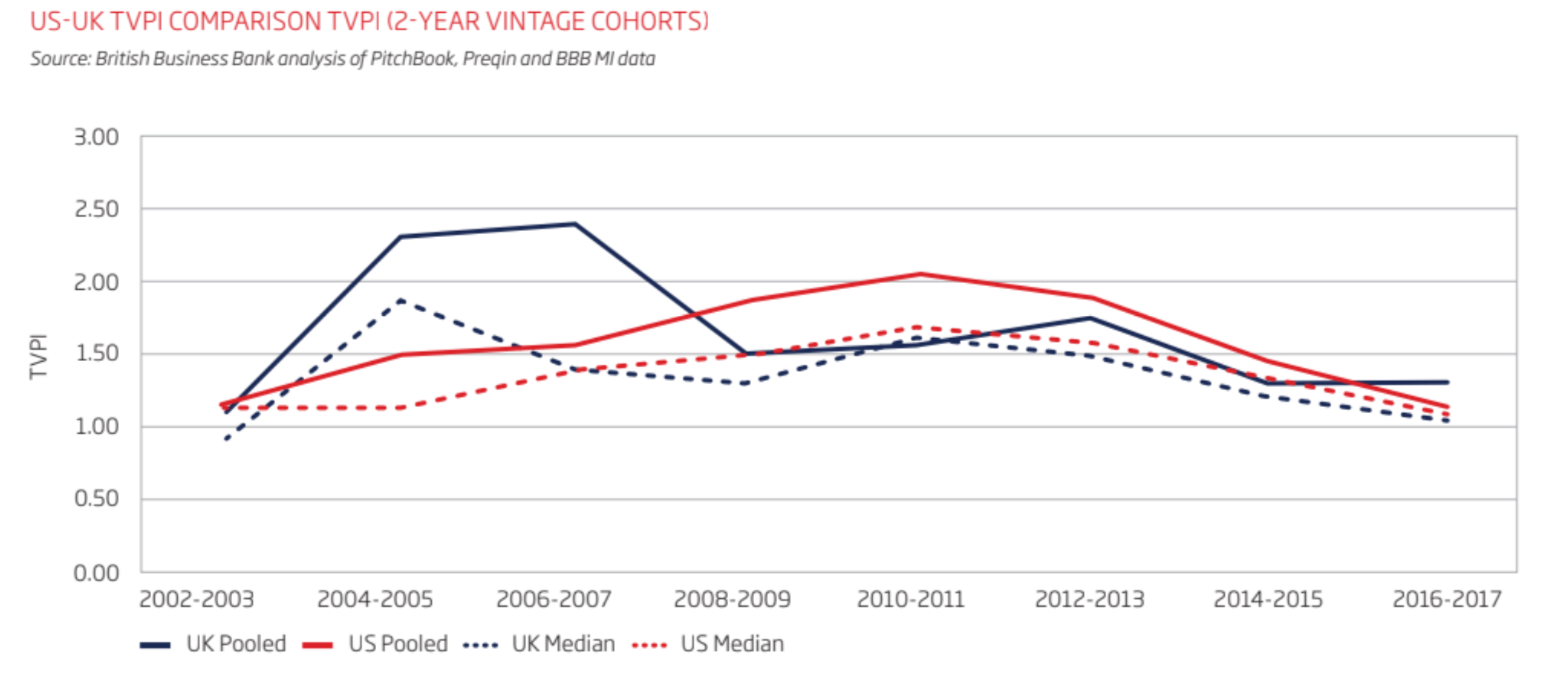

Over time funds in the UK and the US have seen their relative fortunes vary, with UK funds often outperforming those in the US in terms of the average ratio of returns to the amount invested.

From 2002 to 2007 there was a sustained period when UK funds had higher returns than their US counterparts.

Now it appears that UK funds may once again have pulled ahead of their US counterparts, with the most recent data from 2016-2017 seeing slightly higher returns in the UK.

Source: British Business Bank

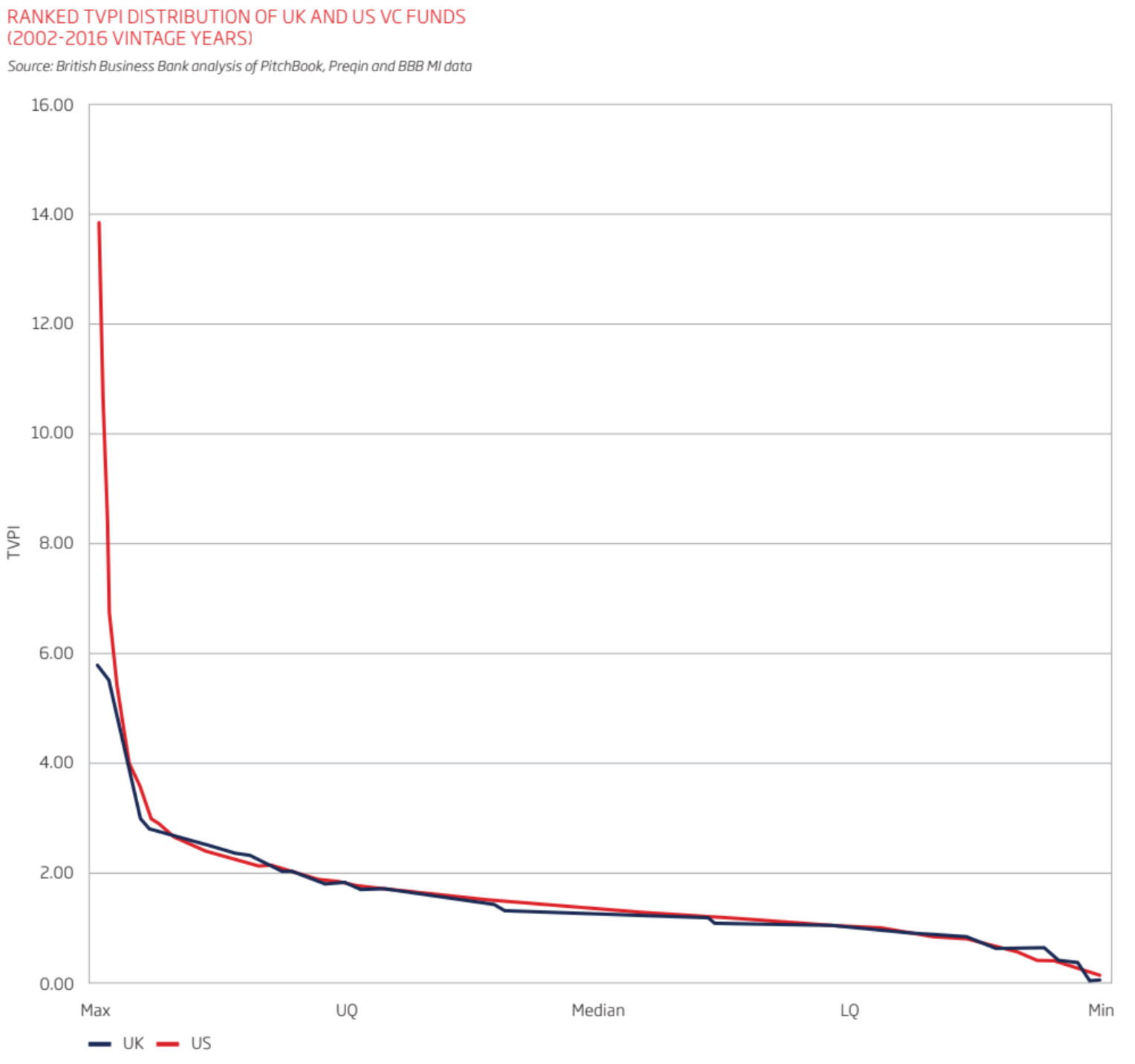

One key difference between the two countries is that the US has a handful of standout funds that dramatically outperform the highest performing funds in the UK on a consistent basis.

To illustrate, the most successful fund in the US achieved a ratio of value to investment of 13.8, while the highest in the UK was 5.7.

But this difference applies only to those at the very top, while the broader picture shows that UK venture capital funds tend to earn similar amounts. According to the report there is only a difference between the two countries for the top eight percent of funds. For the remaining 92% the distribution of returns is “almost identical”.

Source: British Business Bank

To investigate returns the report used a measure called the 'Total Value to Paid-In' capital (TVPI) — a way of calculating a fund's total value as a multiple of its investment costs.

Alice Hu Wagner from the British Business Bank commented that the report “makes a specific case for UK venture capital within global venture capital allocations”.