Truecaller has had a rocky few years. The Swedish messaging startup has been hacked by the Syrian Electronic Army, bullied by the Swedish press and criticised for making less money than a hotdog stand.

But the company now seems to have turned a corner, with 140m daily active users around the world and with the last funding round at a 7,2bn SEK valuation in summer 2018, there is an expectation that it will raise its next one at a billion-dollar valuation. Helpfully, it is also on the brink of profitability.

And most startlingly, the company seems to be succeeding just where Facebook seems to be struggling: turning a messaging app into a financial services company where users can pay bills and do peer-to-peer payments within the app.

Alan Mamedi, the chief executive of Truecaller, tells Sifted that he has been strengthened by all the criticism: “In a way, there are only two paths to choose from. Either you lie down and cry or you get up and give everything you have to show them.”

What is Truecaller?

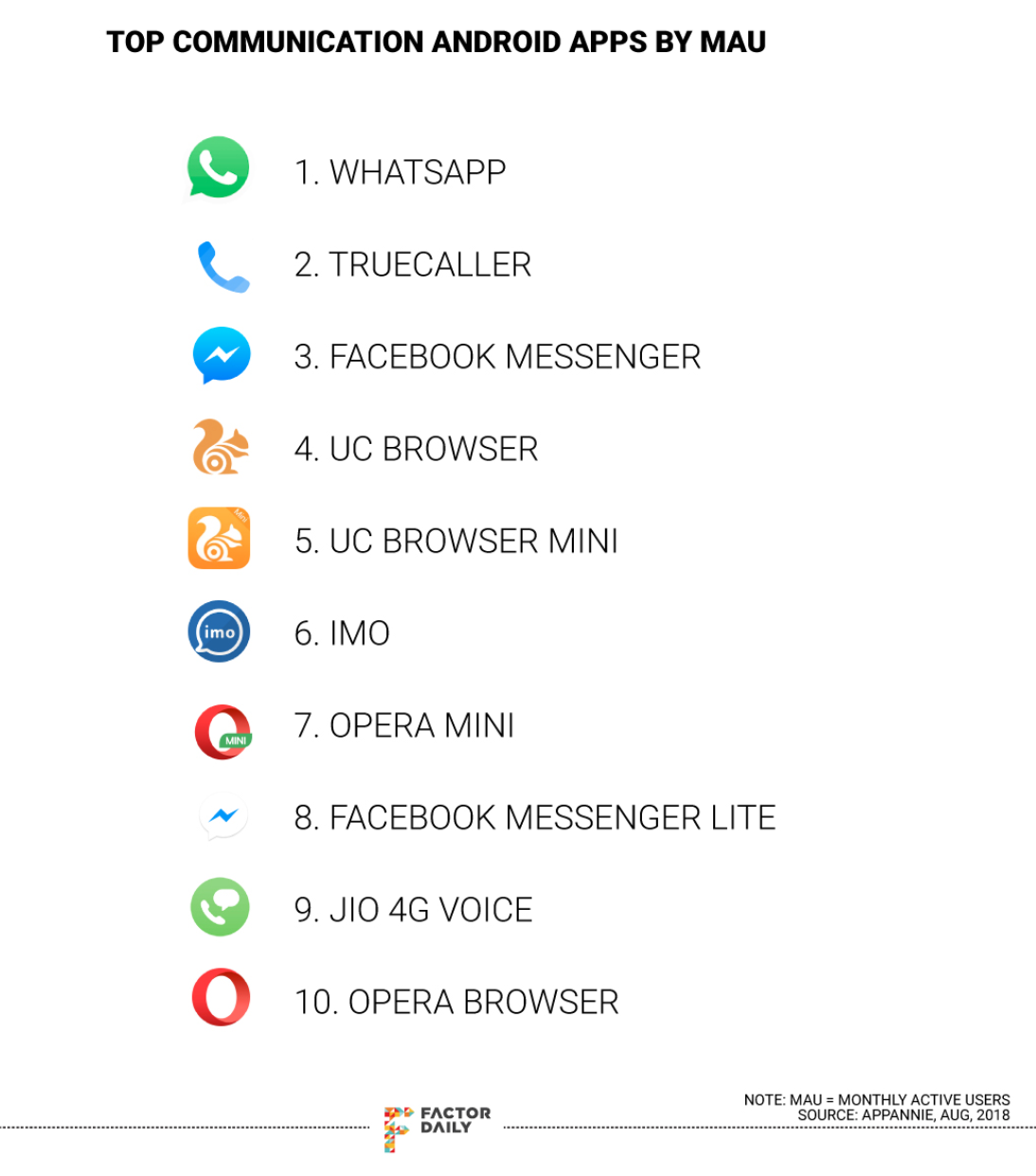

Truecaller, which was founded in 2009, is almost unknown in Europe where it only has a small number of users. But in India, Truecaller is one of the most used daily apps and is often compared to Facebook.

It isn't a super app like Chinese Wechat but it has a number of different services rolled into one. It was originally an app that helps users screen spam calls (particularly useful in fraud-heavy emerging market countries). Then it became a chat app akin to Whatsapp. Now it’s also a payment solution and soon it is handing out loans.

Your phone is open to the whole world and in some way we are creating a peep-hole to see who the other person is.

Sifted met Mamedi, in the office on Kungsgatan in Stockholm. The company, which has about 180 employees, about half of them in Sweden, is about to expand into a new office and hire another 70 people. But this particular Friday, there are no signs of the coming move.

Mamedi, dressed in a light blue shirt, leans back in his chair and talks openly about the years that passed.

He and Nami Zarringhalam, who have founded three companies together, rarely talk to the press or are seen on tech conferences. Two years ago Mamedi appeared on stage at the Finnish tech conference Slush where he advised startup founders not to waste time at events but actually work away on their idea instead.

Syrian Electronic Army

Like all startups, Truecaller has gone through a variety of dips since the start.

One bad moment in 2013 did not get much attention in Europe, but certainly did in India.

The hacker group the Syrian Electronic Army broke into the site and, they claimed, took access codes of more than one million Facebook, Twitter, Linkedin, and Gmail accounts.

Truecaller admitted there had been a security breach, although said that no access codes had been taken. For someone in the west, Facebook’s data breach problems of 2018 spring to mind, where the personal information of 50m users was exposed.

The company had some problems in 2015 as well. They were not making money and, amid a slowing Chinese economy, raising capital got tougher. Having raised almost $80m from the likes of Sequoia, Kleiner Perkins and Atomico, Truecaller realised that it had grown a little too fast.

Many of the positions at the company were filled without a clear purpose which ended up harming the company, according to the founder.

“We realised that the market was changing and we had to change with it. We had grown to quickly and we did not have enough people in senior positions to manage the organisation we had at the time. Our shoes were too big and we needed to cut down to start fresh,” Mamedi says.

Thinking in dollars

Apart from getting rid of a number of employees and restructure the company, Mamedi and Zarringhalam wanted to shift the focus of the company to making money.

“We wanted to focus on income, not to end up in a situation where we constantly needed to raise money to survive,” he says. “We had been lucky with large organic growth but it is a big mental change in an organisation when you tell everyone to start thinking in dollars”.

Mamedi and Zarringhalam wanted the board on their side when slimming the organisation and changing focus to profitability.

“We had a discussion with the board but also with Shailesh [Lakhanii at Sequoia] to ask him of his opinion. He said, ‘look guys, do what you want. I’ll back you.’ That was all we needed to hear”.

It is a big mental change in an organisation when you tell everyone to start thinking in dollars.

Although Truecaller has had a lot of support from its investors, Swedish media hasn’t been as understanding and has time and again pointed to the lack of revenue in the company. As one article in the Swedish press put it in 2016 – Truecaller is making less money than a hot dog stand.

Mamedi says that he does not take offence at the Swedish media often portraying Truecaller as a sinking ship, but says that he has been spurred by it.

“It gives me motivation. I think my life has always been that way, all the way from teachers at high school telling me that I wouldn’t succeed in life. But those things give me enormous strength in wanting to prove them wrong,” he says.

We will be better than Klarna.

In the middle of the interview, Truecaller’s receptionist comes into the meeting room and puts down four ice creams on the table. It is a hot Friday afternoon in Stockholm.

For years, Truecaller has not been making any money at all. But that has now changed.

Due to more than 300 partnership, advertisement and premium memberships, the company’s revenue ended on approximately €20m and losses of €7m for 2018. According to Mamedi, 2019 will not be a year of break even but it may have a positive bottom line in 2020.

“We could have had a positive result in 2017 if we hadn’t acquired Chillr, which has no revenue at all”, Mamedi says.

Becoming a money lender

The Indian multi-bank payments app Chillr was acquired by Truecaller to expand its fintech operations in India and to make it possible to pay bills and do peer-to-peer payments within the Truecaller app. The service also means that users can receive an invoice via a text message in India, and can pay it by just clicking a button.

“Our plan is to get as many users as possible to link their bank accounts to Truecaller. By doing that they can do all kinds of transactions and with our identifier [software], Truecaller SDK, log in to other applications.”

Within the next couple of months, the company will also launch Truecaller Credit in India, which will provide people on the platform with loans at market rates. Mamedi gives the example of a person receiving an electricity bill that he or she cannot pay at the moment. With a click of a button, that person can apply for a loan and get a yes or no within minutes.

Our plan is to get as many users as possible to link their bank accounts to Truecaller. By doing that they can do all kinds of transactions.

“We will do the credit check locally in the unit to see if they are creditworthy. All of this is done offline by looking at their data like past transactions, messages of bounced payments, how often they get invoices etc. If they then want a loan we will pass it on to a partner company that will do the last check,” Mamedi says.

When asked if Truecaller will become the new Klarna of India, Mamedi says “We will be better than Klarna”.

In comparison to Klarna, which specialises in helping users pay for shopping online, Truecaller will not become a bank on its own but will only refer people to their bank partners.

Whatsapp – poor competition in payments

Truecaller’s Indian users’ interest in fintech services is on the rise. In India, 70m of the country’s 1.3bn population are today doing their banking on their mobiles. Since Truecaller launched its payment services in May last year it has taken 15% of the market. According to Mamedi, the company is growing at the pace of one-third of the market growth in India.

“As a messaging app we are far from the biggest but as a one-stop-shop, we are one of the biggest in many countries, India among them. As our messaging app grows, the more payments will go through it when sending money to each other within the space of a conversation.”

Facebook’s Whatsapp is the most popular messaging app in India, and in many other places in the world, have had a problem getting its peer-to-peer payment services running in the app in India.

As a messaging app we are far from the biggest but as a one-stop-shop, we are one of the biggest in many countries, India among them.

According to Mamedi, India has a requirement that all the data is stored locally, which Facebook has yet to conform to. Therefore they are limited to only 1m payment users in the country until that problem is solved.

Apart from Whatsapp, there are numerous other person-to-person payment services available, like leading Google Pay as well as Paytm, PhonePe and now also Amazon Pay. But India is not always an easy market.

There are lessons to learn by others that have tried their luck on the growing market of India.

One of them is Tencent’s super app Wechat, which has 1bn users in China. The company launched a service in India but failed shortly afterwards. According to some, it had to do with a combination of the Indian’ government threatening to shut it down and the failure to attract businesses to the platform.

Global Yellow Pages

As the second most used chat app for Android, Trucaller’s founder believes that peer-to-peer payments are best located within a conversation. And since Truecaller’s core is to tell the user who is calling and whether it is spam or not, Truecaller makes the banking experience more secure.

But what is really the USP of Truecaller core – the global yellow pages?

In Sweden, people may get one or two spam calls a day that Truecaller can pick up on but that is not enough to create a huge demand. In India however, Mamedi talks about how people get dozens of spam texts a day and callers trying to scam people by wanting your bank account details or in other ways. In Nigeria, where Truecaller also is big, there has been a problem of kidnappers trying to get information about family members to be able to receive ransoms.

Maybe it isn’t surprising that Truecaller has grown most in countries with a bigger need than in for example in Europe. That is probably the reason that the company, with its latest valuation of more than $680m, is so unknown in this part of the world.

Do we want to be in emerging markets where there is a constant daily growth or in Europe and the US?

“Our philosophy has always been, grow organically and when we reach a critical point, let’s start the machinery. So, we haven’t really focused on Europe due to the fact that we have seen the potential in other markets,” Mamedi says.

“And because of a decision we made several years ago, we have limited resources to decide where to play. Do we want to be in emerging markets where there is a constant daily growth or in Europe and the US? The cost of growth in the US and Europe is also greater and there is a lot of competition here.”

Hello Africa

Why India has grown so much is probably due to the fact that it both had a problem with spam and no yellow pages as such. The greater community could see a need for a mobile application where users could warn others of scam.

“A lot of our core is that we stand for more secure information. Your phone is open to the whole world and in some way we are creating a peep-hole to see who the other person is,” Mamedi says. “I believe that all successful companies start with one problem and then goes on from there.”

Our philosophy has always been, grow organically and when we reach a critical point, let’s start the machinery.

Apart from India, where Truecaller has three offices and almost half of the companies employees, the company is also putting efforts into its markets in Africa.

“Focus is now on Nigeria, Kenya and South Africa but we are pretty big in just about all African countries. We have a great penetration there and the smartphone penetration is okay. In Nigeria, it is growing at a fast pace and we grow at the same speed as the market so that is fun.”

Truecaller will most probably continue to focus on the emerging markets and won’t mind being a forgotten startup in Europe. However, when it raises its next round at a billion dollar valuation, then it will be more difficult to stay under the radar. Unicorns rarely do.