Solar is one of the pillars of the green energy transition — and investors want in.

The most recent company to benefit from big-money interest is Swedish solar startup Alight, which announced today that investment company DIF Capital Partners has purchased a majority stake in the business. The deal also includes a €150m investment and lets several early investors cash out.

Companies like Alight do not usually raise much venture capital since the money needed for planning and building solar parks is more likely to be financed by private equity or bank loans. An investment from a deep-pocketed investor can make it easier to have a bigger impact on the European energy supply.

What does Alight do?

Founded in 2013, Alight offers solar-as-a-service to the commercial sector — companies, after all, use about 70% of all electricity produced. Alight builds solar panel systems for commercial and industrial customers across Europe with the help of subcontractors and then supplies the power to the company through a special agreement called a power purchase agreement (PPA). Panels are either in solar parks that feed power to customers via the electricity grid or on the roofs of factories and commercial buildings for companies like Toyota.

Alight customers pay a fixed price for the electricity when the solar panels are installed and produce electricity. In the past, solar energy prices were seen as expensive, but now, with a hike in gas prices as well as carbon pricing, they suddenly look very competitive.

“Solar remains the cheapest and quickest energy source to scale, so building more to deliver energy security and reduce emissions are crucial,” Alight cofounder Harald Överholm says.

The plan forward

The two founders still working in the business — Överholm and Richard Nicolin — still have over 10% of the company after the transaction, sit on the board and are still working there, Överholm tells Sifted.

“Many of our early investors remain, to be part of the upside they see going forward in the company. Those of our early investors who sold have had very good value development,” far above returns from the stock market, for example, in the same period, he said. He declined to give exact figures.

DIF, with assets under management of about €14bn, invests in infrastructure companies and assets. For Alight the investment means that it can scale up its initial target of building one gigawatt (GW) of solar assets by 2025 to a goal of 5GW solar projects delivered across Europe by 2030.

And the timing is good. With surging energy prices, one of the selling points for Alight is that its solar parks protect major power users from price surges by offering fixed prices on 10-20 year contracts.

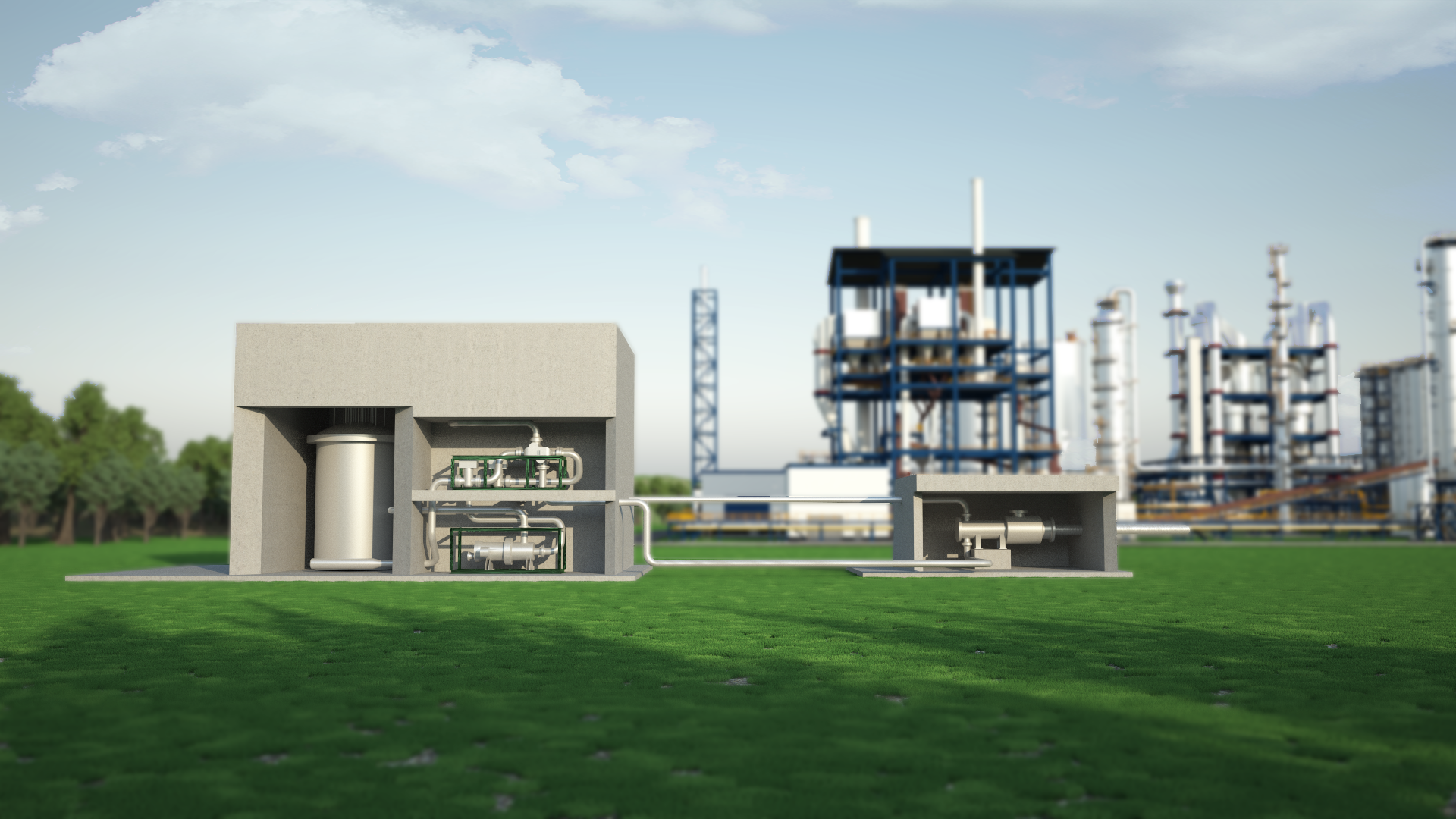

Alight is also leading the Swedish market rollout of co-located battery storage, by adding battery storage to one of its 12-megawatt solar parks in Sweden earlier this year. Battery storage is a key component to provide energy when the solar energy system is not producing, for example at night, or during grid failures.