We’re at the beginning of a whole new era for startups — one in which capital is scarce.

It’s no longer about growth at all costs; "business basics" are now back in vogue. And the upshot for startup founders is — as always — those who are quickest to adapt will be those who are most likely to succeed.

A new era requires new metrics for tracking performance. Here are the benchmarks and data points that every founder should be tracking as the tides change.

Why are we in a new era?

2022 was a watershed moment for the venture capital industry.

Not only because venture capital funding was down 35% year-on-year, but because there’s been a sea change in the macroeconomic environment in which it operates. Specifically, the past decade of close-to-zero interest rates has unequivocally come to an end.

Now capital can generate much higher returns in less risky asset classes like bonds. And the decimation of late-stage valuations has prompted a flight of capital, meaning the flipping of chronically unprofitable startups to later-stage funds has now come to a shuddering halt.

In the brand new, higher interest rate era, the bar is now much, much higher for startups looking to raise

Investors have spent the past 12 months doling out advice to founders about “cutting burn” and “extending runway”, while simultaneously speculating about when things will be “back to normal” — after all, they like writing cheques as much as we like receiving them. The reality, however, is that there will be no “back to normal”: in the new, higher interest rate era, the bar is now much, much higher for startups looking to raise.

Out with the old

In the old world of capital-fuelled growth, founders were predominantly running their businesses focusing on month-on-month growth of their North Star metric — the one metric they had chosen as the overall guiding light of the business.

Metrics such as gross merchandise value (GMV), number of transactions, number of accounts/clients signed up, contracted revenues and even monthly active users (MAUs) were all contenders. The ratio of customer acquisition costs to the customer lifetime value (CAC/LTV) was also a popular metric. It was a nod to business fundamentals, as — in a world of almost free capital — if you could make the unit economics work it made sense to grow as quickly as possible.

While these metrics are still helpful to give a sense of the momentum of the business, they’re not particularly good at indicating the true underlying health and longer-term prospects of the business. This is where the new era metrics come in.

In with the new

With the easy money days over, founders now need to focus on making their businesses much more sustainable, given they’re likely to find it harder to raise external capital. Plus, having solid business fundamentals makes you much more investable too.

With the easy money days over, founders now need to focus on making their businesses much more sustainable, given they’re likely to find it harder to raise external capital

Here are some things to think about as you define your core metrics for 2023:

North Star metric — Does your North Star metric need revisiting in light of this brave new world? At Olio we’ve changed ours from the number of listings coming onto the app (as we’ve always been a supply-constrained marketplace) to annual recurring revenue (ARR), in recognition of the fact that revenue trumps growth in this new environment.

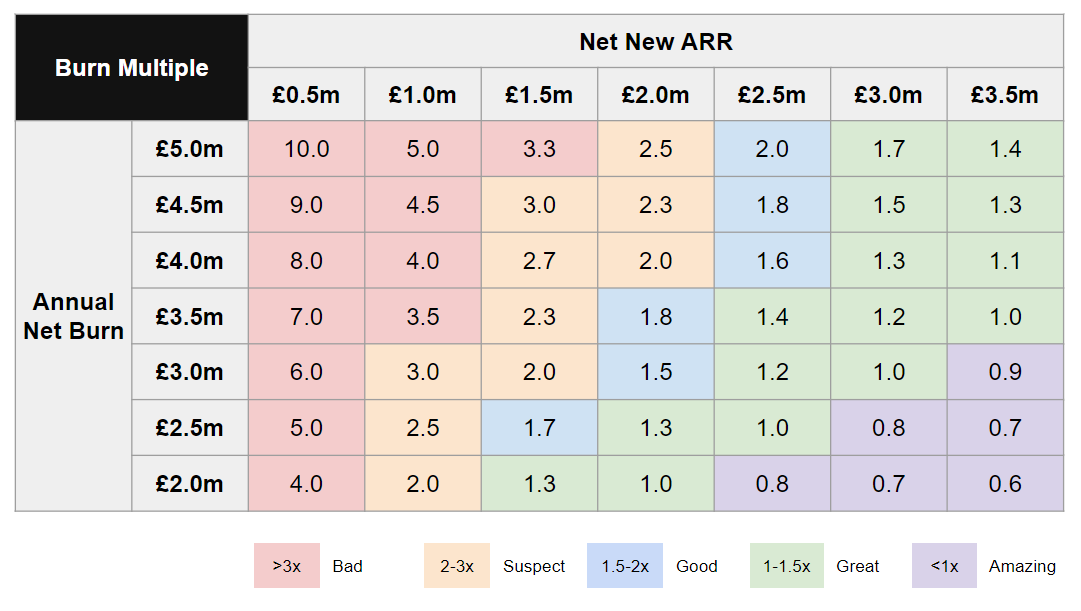

Burn multiple — This is a metric that’s burst onto the scene in the past few months and is essentially a proxy for how efficiently a company is growing. It measures the amount a startup is spending in order to generate each incremental dollar of ARR and is calculated by dividing the net annual burn rate by the net new ARR. A burn multiple of <1x is considered amazing, 1-1.5x is great, 1.5-2x is good, 2-3x is suspect, and >3x is bad.

An important thing to consider when looking at your burn multiple is which lever will be most powerful in getting it into the good zone: decreasing costs or increasing revenues? This is something that each company needs to figure out for itself, but as the table below shows — where halving the burn rate still leaves the company in the bad zone — sometimes revenue growth can still be the most effective strategy.

Rule of 40 — The cousin of the burn multiple, the Rule of 40 is well-known in the SaaS world and is a metric that combines a company’s growth rate and profitability. It’s calculated by adding a company’s year-over-year revenue growth rate to its Ebitda margin (more of which below). It’s worth noting that the Rule of 40 is most useful for more mature companies, as at the earliest stage of a startup, growth and profitability are more often than not in direct conflict with one another.

Ebitda (earnings before interest, taxes, depreciation and amortisation) margin — This is old-school business 101 and a classic measure of profitability. While the majority of early and even growth-stage companies are unlikely to be Ebitda-positive, it’s now imperative to at least understand your path to positive Ebitda, and to have a view as to what sort of Ebitda business you’re ultimately building.

Payback period — In place of the CAC/LTV metric now comes the “payback period”. In other words, the time needed to recoup the costs of acquiring a customer or making an investment. This is much harder to fudge and really helps focus the mind on the time horizon that the company, and its investors, are prepared to invest across. With payback periods now being top of mind, we’re likely to see a retreat from the aggressive international expansion and speculative brand extensions of the past few years and much more focus on investment in core markets with their shorter payback periods.

Productivity — If there’s one thing the Twitter lay-offs have done — beyond providing a masterclass in how not to conduct redundancies from a legal and communications perspective — it’s to shine a light on the concept of employee productivity. Investors are now abuzz with conversations about "right-sizing" their "overweight" portfolio companies, with metrics such as revenue per head and revenue per sales head now front and centre.

Market leadership — Over the past couple of years you could be the third, fourth, fifth or even 10th quick commerce startup and get funded, in what Jason Lemkin dubbed the "Postmates effect". However, in this new era, we’re back to how things have always been: most markets are winner takes all. This means you need to credibly demonstrate how you’ll get to number one or two in your category, and stay there.

Impact — You might be surprised to see this on the list, but over the next decade every startup is going to need a firm grasp on its impact beyond just revenues, job creation and customers. You’ll need a dashboard of your core impact metrics which will likely include your carbon emissions, resource utilisation, pollution, biodiversity and social equality impact. Ultimately there will be no return on investment better than investing in the future of humanity, meaning strong impact metrics will command the very highest valuations, so it’s worth getting ahead of the game.

Master of your own destiny

During the sea change we’re undergoing, it's really important for founders to be on the front foot. If you proactively lean into this new era, you can avoid investors micromanaging over your shoulder and make your business more investable. On both counts, this takes you one step closer to being the master of your own destiny.