Fintech Pleo has raised $150m at a $1.7bn valuation, giving Denmark its eighth unicorn. It also means Pleo has reached the milestone valuation faster than any other Danish company, taking just over six years.

The company offers company cards and automated expense reports for employees, aiming to help staff make work purchases while giving employers visibility. It works as a subscription model, starting at £6 per user.

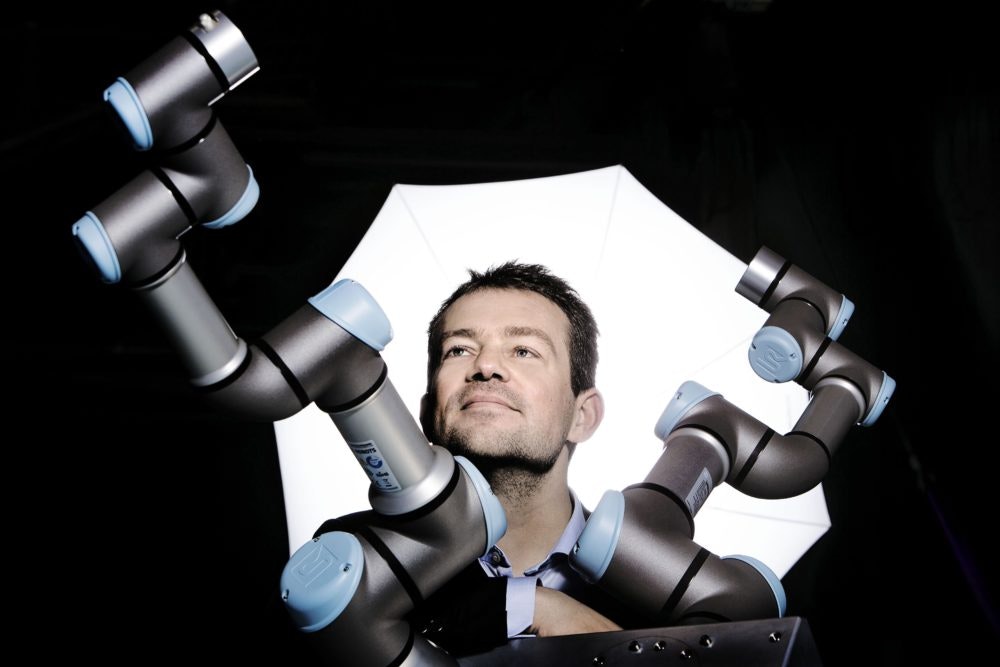

“A large number of companies that come to Pleo do so because they are still heavily reliant on manual, decentralised, paper-based processes,” says CEO and founder Jeppe Rindom.

Updating employee spending has become even more critical during the pandemic — during which Pleo has seen its customer base grow by over 125%. The company is now used by 17k companies across Denmark, the UK, Sweden, Germany, Spain and Ireland. It’s aiming to increase the number of users to 1m by the end of 2025.

Pleo’s record comes as round sizes in Europe continue to grow. Its Series C is the largest yet in Denmark, followed by virtual lab startup Labster, which raised $60m in February this year; and mobile-based banking app Lunar Way, which raised $40m at the end of 2020.

Meanwhile, Lenus, a platform to help fitness instructors build their businesses, raised the country’s biggest ever Series A at €50m last month.

Spend management

Pleo sits in the highly competitive corporate spend management market. Expensify and Concur are two notable incumbents, alongside younger competitors like Soldo and Spendesk.

“Distributed workforces have increased the need for businesses to set up their teams for success, while automating and keeping a close eye on their company spending,” Rindom says.

Pleo plans to use the new funds to grow its customer base and expand its team — which currently stands at 330 people — as well as developing new features.

“We are fully focused on our operations in Europe right now, but will be considering a new continent to expand to in the near future,” says Rindom.

“The US is certainly a region we are looking into given the size of the market, but there are still a number of important factors we need to consider before we take this step, and want to ensure our solution is as strong a position as possible before doing so.”

Founded in 2015, Pleo is now among the best-capitalised startups in its genre. Its latest round, co-led by Bain Capital Ventures and Thrive Capital, brings the company's total fundraising to $228m. Early investors include Creandum, Kinnevik, Founders, Stripes and Seedcamp.

Unicorn country

Pleo’s new unicorn status means Denmark has now produced eight unicorns: Zendesk, Unity, Tradeshift, Sitecore, Trustpilot, Net Company, Chainalysis and Pleo.

Pleo claims to be the fastest of the lot, reaching the $1bn milestone in just over six years, as well as being the first (pure) fintech to do so.

Skype was also founded by a pan-Nordic team from Denmark, Sweden and Estonia; and Just Eat was founded in the UK by five Danish entrepreneurs.