Despite the myriad solutions available in the fintech world, access to products and services remains uneven.

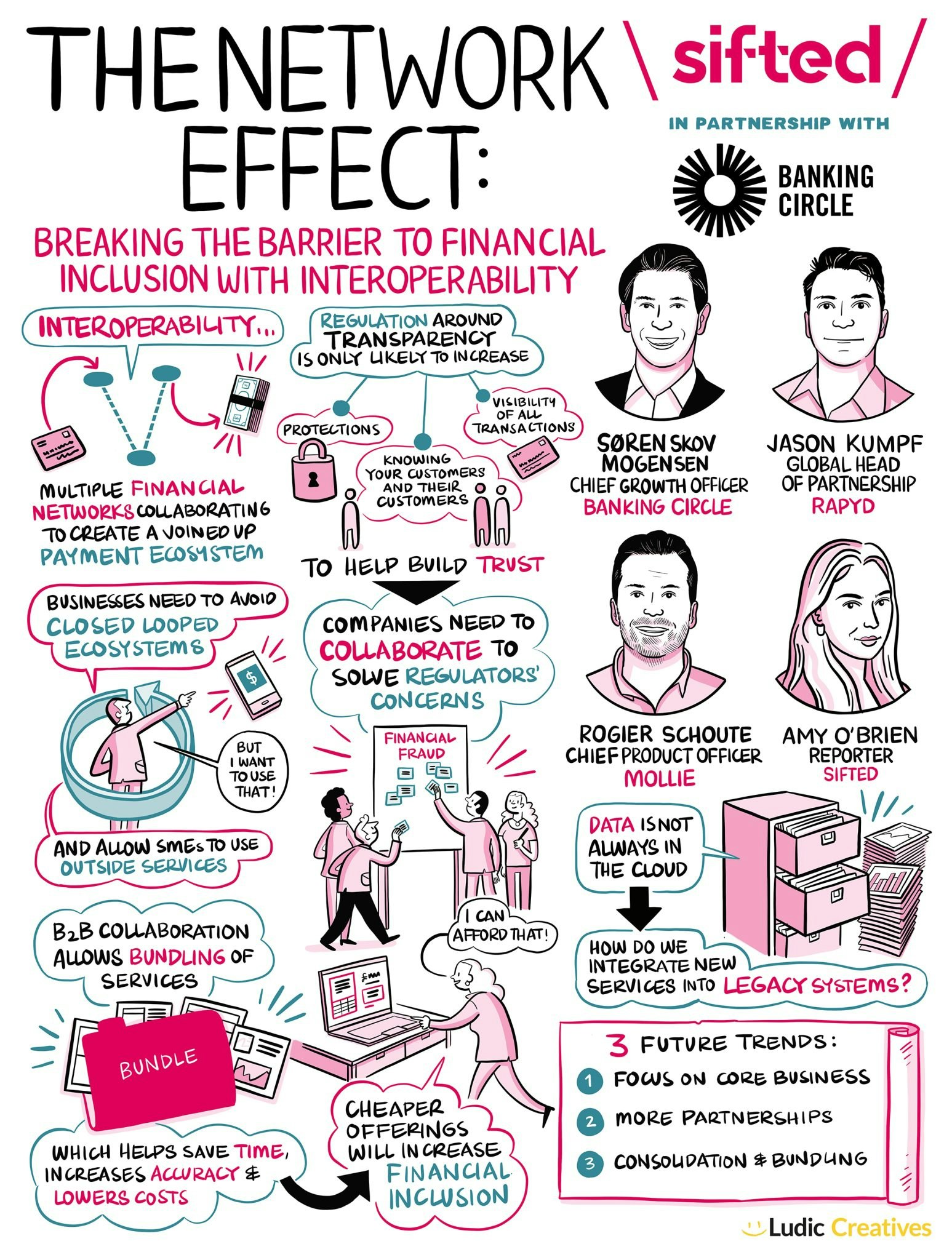

Interoperability is where different systems and applications communicate with each other without effort from the end user.

It may offer a future of greater financial inclusion, as previously siloed systems can become connected — reducing administration times, quickening the pace of innovation and lowering costs for both businesses and consumers.

How does interoperability improve access to financial products? What are the challenges businesses face in regards to regulation, and how can platforms work together to weather the upcoming economic storm?

We put these questions to our expert panel of payments specialists on our latest Sifted Talks. Our speakers were:

- Rogier Schoute, chief product officer at payments platform Mollie

- Søren Skov Mogensen, chief growth officer at fintech Banking Circle

- Jason Kumpf, global partnerships lead at payments platform Rapyd

1. How interoperability can drive better financial inclusion

The talk started with definitions of key terms. Schoute explained that interoperability for fintech is the idea that payment schemes and processes can feed into other functions of a digital finance system.

Both Schoute and Kumpf explained how this drives financial inclusion, as businesses of all sizes can access compatible fintech which they can use in their offerings to their customers, who may have been previously excluded.

Interoperability is when multiple payment schemes or networks work together to create a holistic financial experience… As an industry we realised our schemes and services aren't always compatible with each other” — Rogier Schoute, Mollie

2. Interoperability can help SMEs and startups navigate regulation

Small and medium-sized enterprises (SMEs) often face barriers in setting up their financial systems. This is due to market attitudes as well as regulation.

Mogensen explained that SMEs often become bogged down in operational headaches such as acquiring IBANs in new markets. Looking ahead, the rollout of legislation such as PSD2 and PSD3 will increase the burden of regulation with regards to anti-money laundering and know your customer (KYC) practices.

For small fintechs themselves, regulation can differ greatly across regions. Greater interoperability gives startups the ability to pass regulatory burdens onto existing platforms — allowing them to innovate without high costs and increased workloads.

We've tried to use technology to make things more efficient and make sure that SMEs can — through the scale and technology advancements we create — access great products. Technology really helps to break down regulatory burdens” — Schoute

3. Interoperability improves customer satisfaction — and saves everyone money

Interoperability also allows API-driven solutions to be bundled together, creating a product which requires little internal development time.

Schoute said that these products were proving popular with customers because end users want systems that share data, as it reduces the time they spend administering finances. The savings made by the fintech can also be passed onto their clients, reducing service fees.

We're all going to have a lower cost. We're getting more clients, we're offering more. That helps the end client tremendously” — Jason Kumpf, Rapyd

4. Anti-money laundering technology is here, but data must improve

A number of applications have been built using AI that will improve anti-money laundering and KYC processes. Mogensen highlighted AI company Sentinels as an application that has the potential to flag suspicious transactions across a multitude of different payment platforms.

However, he said the quality of data held by legacy banks and financial institutions, on which many smaller businesses rely, was lacking. Many of these legacy players still host large chunks of information away from the cloud, slowing down the proliferation of interoperable products.

We have to face facts and realities, data is not always in a good order… the challenge is to take these brilliant systems and make them applicable also in the incumbents” — Søren Skov Mogensen, Banking Circle

5. Partnerships will be crucial in the downturn

Mogensen gave three predictions for B2B fintechs over the next five years. With businesses scaling back headcounts, he anticipates: a period of businesses focussing on their core offering, prioritising delivery over innovation; more partnerships between platforms to create a “rich and sticky proposition”; and consolidation through mergers and acquisitions.

Both Kumpf and Schoute agreed with these predictions, highlighting just how crucial partnerships will become. Kumpf pointed out that partnerships cost less, and are less risky than official mergers, while Schoute explained that working together will allow fintechs to better access different markets as they expand. The move towards interoperability across financial services will facilitate these relationships.

We will see that as each company focuses on its core delivery, they will come together to deliver strong solutions through partnerships” — Mogensen

6. The line between collaboration and cooperation will blur

As interoperability proliferates, the difference between collaborators and competitors becomes less clear.

Schoute explained that most businesses are becoming more transparent anyway. Feature roadmaps would have been unthinkable a decade ago, but fintechs are happy to publish their future features, as they are “less afraid” of their competitors, and believe that delivery is a more important selling point.

With smaller solutions now building on top of existing fintech platforms, creating applications for niche audiences, the line between competition and collaboration has blurred. Kumpf described this as a new paradigm of “cooperatition”, where big companies handle regulatory barriers, and allow other players to iterate quickly, creating more solutions for the end user.

The end client now has choices, right? If you're the underlying fintech offering, those smaller groups can now take that and add value to niche segments, instead of you trying to go after all these niche segments” — Kumpf

Like this and want more? Watch the full Sifted Talks here: