French freelance platform Malt has raised €80m as it seeks to expand across Europe to meet growing demand from large corporates for freelance talent.

Since its founding in 2013, the company has been growing by connecting freelancers with gigs in its main markets of France, Germany and Spain. Even amid signs that Covid-19 case rates are receding, Malt CEO and cofounder Vincent Huguet said he believes companies will continue to expand their use of freelancers as they shift to more hybrid systems of employment.

"Basically what happened in the last five years is that we moved from being an option for SMBs to [being one for] bigger companies," Heguet said. "So a big part of our revenue now is being done with corporates in France and Spain, and now starting in Germany."

Malt's funding follows a blistering stretch for the French tech ecosystem. According to La French Mission, startups in France have raised €2.3bn in 2021. That includes €1.75bn by just eight companies since mid-April, topped by ContentSquare's recent €408m round that set a new record for VC funding in France.

While Malt didn't break the nine-figure fundraising barrier, Heguet said the company had greater demand from investors but opted to limit participation to keep the company's cap table clean. Goldman Sachs Growth Equity and Eurazeo led the round, another sign of French startups' growing ability to attract scaleup funding from international investors.

"We didn't want too many players coming in," Hugeut said. "But we wanted some very big pockets. If we need to do an acquisition in the future, we want to have people around the table who can help us do that."

The future of freelance work

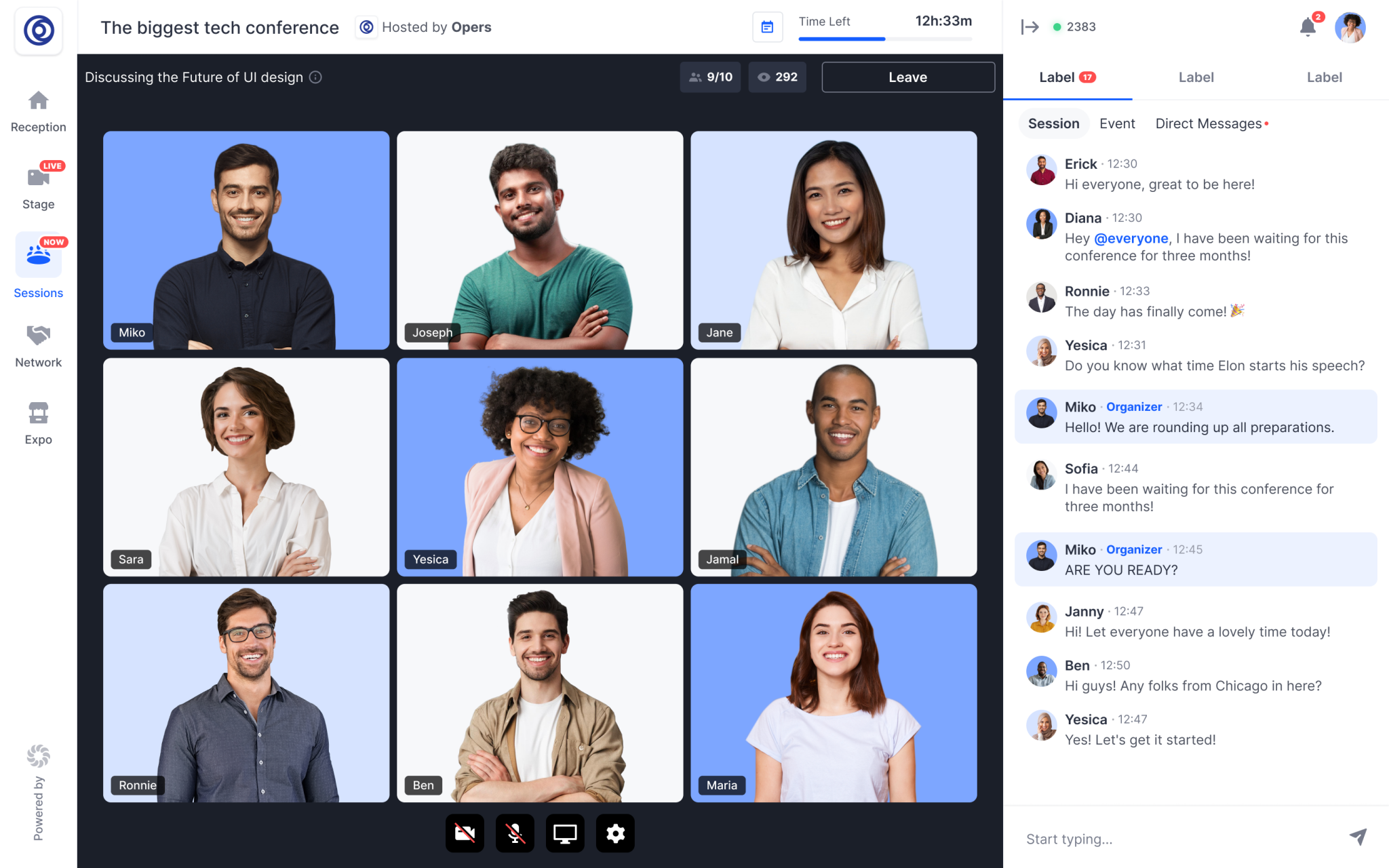

Malt began as a straightforward marketplace for freelancers, but has continued to grow by expanding its services for companies. Currently, Malt has about 250k freelancers on the platforms with about 8k joining each month.

Heguet said the pandemic led even more people to rethink their career options. The bulk of freelancers on Malt are there by choice, he told Sifted, which makes them appealing to businesses because their profiles tend to be more entrepreneurial.

Malt now has 40k business customers, primarily startups and SMEs. But that has been changing. Today, Malt also works with 80% of the companies that are in France's CAC 40.

It's been developing more robust AI solutions to help these partners rapidly find the talent they need, as well as offering tools to manage freelance services and delivering talent market insights.

Many of these corporate partners are estimating that anywhere from 20% to 30% of their payrolls will be freelance in the coming years, as their search for great flexibility and speed in recruiting talent continues.

They have to adapt to a world where not everyone wants to work nine to six and be seen by the boss at the office.

This focus on big companies is how Malt is trying to differentiate itself from competitive freelance platforms such as Upwork, Freelancer.com and Fiverr. Huguet said his rivals' main focus still tends to be on smaller businesses or gigs.

Overall, the global market for freelance platforms is expected to reach $9.19bn by 2026 up from $3.39bn in 2019, according to a recent report by Orbis Research. While Malt faces well-funded competition such as Upwork, a publicly traded company with a $6bn market cap and a global reach, Orbis also noted that the freelance platform is highly fragmented with the top five companies only accounting for 25% of the overall market share.

That leaves an opening for regional players like Malt, which is currently on track to double revenues in 2021. With the latest funding, the company plans to push deeper into its three main territories by launching in new cities. It's also laying plans for new territories such as Benelux, Italy, the UK and eventually the Nordics.

"We have moved upmarket to bigger and bigger companies by adapting our solutions to them," Huguet said. "And we've seen the big corporates really move in terms of mindset to thinking differently about work. They have to adapt to a world where not everyone wants to work nine to six and be seen by the boss at the office. They are more open to hybrid solutions."

Chris O’Brien is a Sifted correspondent based in France. He tweets from @obrien