Enterprise software emerged victorious from an otherwise tumultuous 2022 for European tech as the year’s best funded sector — and one of the few industries that saw funding volumes further improve on last year’s records; $17.8bn has been raised so far in 2022, compared to $16.9bn in 2021.

It’s a giant industry spanning everything from business resource planning and customer support to HR tools, for companies of many shapes and sizes, from SMEs to global household names.

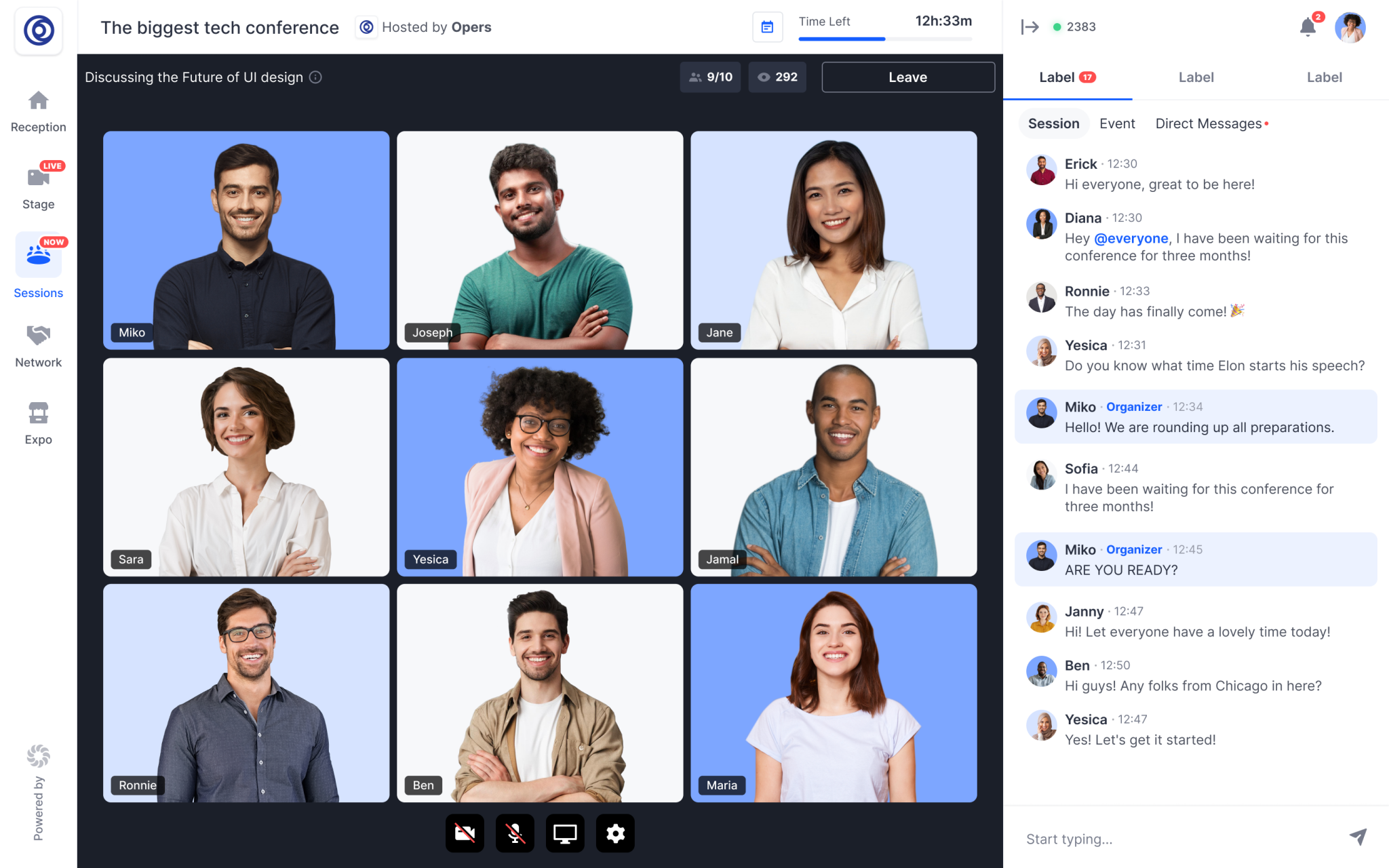

But at our latest Sifted Pro Roundtable — a monthly industry networking forum for our Pro community — only 42% of participants believed that the enterprise software market is looking as fundamentally strong as it did at the start of 2022. Attendants included investors from software-focused early-stage and growth funds, a head of department from a SaaS unicorn and various early-stage founders in the sector.

Here’s what attending founders and investors had to say about the sector’s resilience in a downturn that will leave few industries unscathed.

The downturn is coming for everyone

Enterprise software has been impacted by skyrocketing valuations like any other sector — and so has also been exposed to the savage corrections that swept across European tech in 2022. Public SaaS companies in Europe have seen their multiples fall from 17x to 6x in just one year.

…but in the long run, enterprise software is here to stay

That said, companies will continue to move away from paper to automating manual processes and extracting insights out of real-time data. Enterprise software is now a mature sector that is seeing much faster adoption rates than a few years ago, according to one expert. In 2020 alone, companies’ adoption of digital tools accelerated by seven years.

Easy come, easy go?

One trend that has driven the faster uptake of enterprise software is founders’ greater focus on user friendliness — making their tech “as easy to use as Instagram”, in the words of one participant. But while this may remove barriers in signing up new users, it offers no guarantee for retaining them in a downturn. Certain tools are easy-to-use but also easy-to-cancel. “It’s the tools that provide real ROI [return on investment], the ones that embed themselves deeply in your stack — they're the ones that stay, [rather than] the more experimental [ones],” said one participant.

Sharpen your sales pitch

Participants agreed that, in the current downturn, companies are vetting their buying decisions carefully, forcing startups to more clearly articulate the return provided by their software. More than half of participants indicated that they already cut costs on SaaS spending or are in the process of reviewing their current stack.

More M&A on the horizon

81% of participants said they expected greater consolidation and M&A in enterprise software, but also pointed out that the process can be far from straightforward. Rather than taking place ad hoc, experts expect acquisition decisions to be made in the context of pursuing geographic expansion or additional product features, as laid out in companies’ existing roadmaps for growth.