The last six weeks have seen the largest economic shock in living memory, with half the world’s population currently under social distancing measures and a record 20m Americans now unemployed.

Every chief executive is now faced with a dual challenge. Navigate the immediate challenging environment and plan how to rebuild the business to drive future growth, once the economic recovery begins. In times of uncertainty, companies have the ability to innovate and experiment with new ideas and approaches; in short, these are the conditions where innovation thrives.

A majority of executives say they need to improve the process of embedding innovation projects into the business.

However, recent history is littered with high profile failures of corporates as they try to innovate. So why is it that the only thing many corporates seem to find easy to innovate is the tagline of the project? In a Harvard Business Review survey of 164 executives at companies with more than $1bn in revenue, over a quarter (26%) said that the transition from innovation to the business unit “needs serious work”, 16% described it as “terrible” and the vast majority admitted that there was room for improvement.

When we speak to companies, some of the reasons for this become clear. Many build their innovation strategy with the same approach they apply to their core business. This usually translates into believing that driving future growth can be achieved by placing a few big bets with heavy capital investment into areas that are usually technology-driven. For example a move into blockchain, where they have no or limited capability or the competitive advantage to succeed. Failure is further guaranteed with a lack of aligned expectations around governance, funding and how to measure the return on investment of innovation activity.

Solving this stalemate requires a radical rethink. Using the existing strategy toolkit may work where industries are stable and predictable, but few are stable or predictable any more. New technologies, evolving customer needs and new regulations — not to mention the current pandemic — are disrupting industries at an increasing rate. Companies need a new way of navigating this new level of uncertainty.

Data rather than gut instinct

Companies need to take a data-driven approach. You wouldn’t expect a chief financial officer to rely on his or her ‘gut’ when balancing the books. A chief product officer would not invest budget in developing new products, where there wasn’t evidence to support return on investment. The same principle must apply to how senior leaders look to evolve the business to drive future growth.

You wouldn’t expect a chief financial officer to rely on his or her ‘gut’ when balancing the books.

Startups act as the canary in the mine: they provide valuable signals about where funding is being pumped in from VCs and which areas are highly competitive already. One approach we’ve developed is to systematically look at startup and VC data to identify where it is worth a company developing something new and where it is better to partner with a startup.

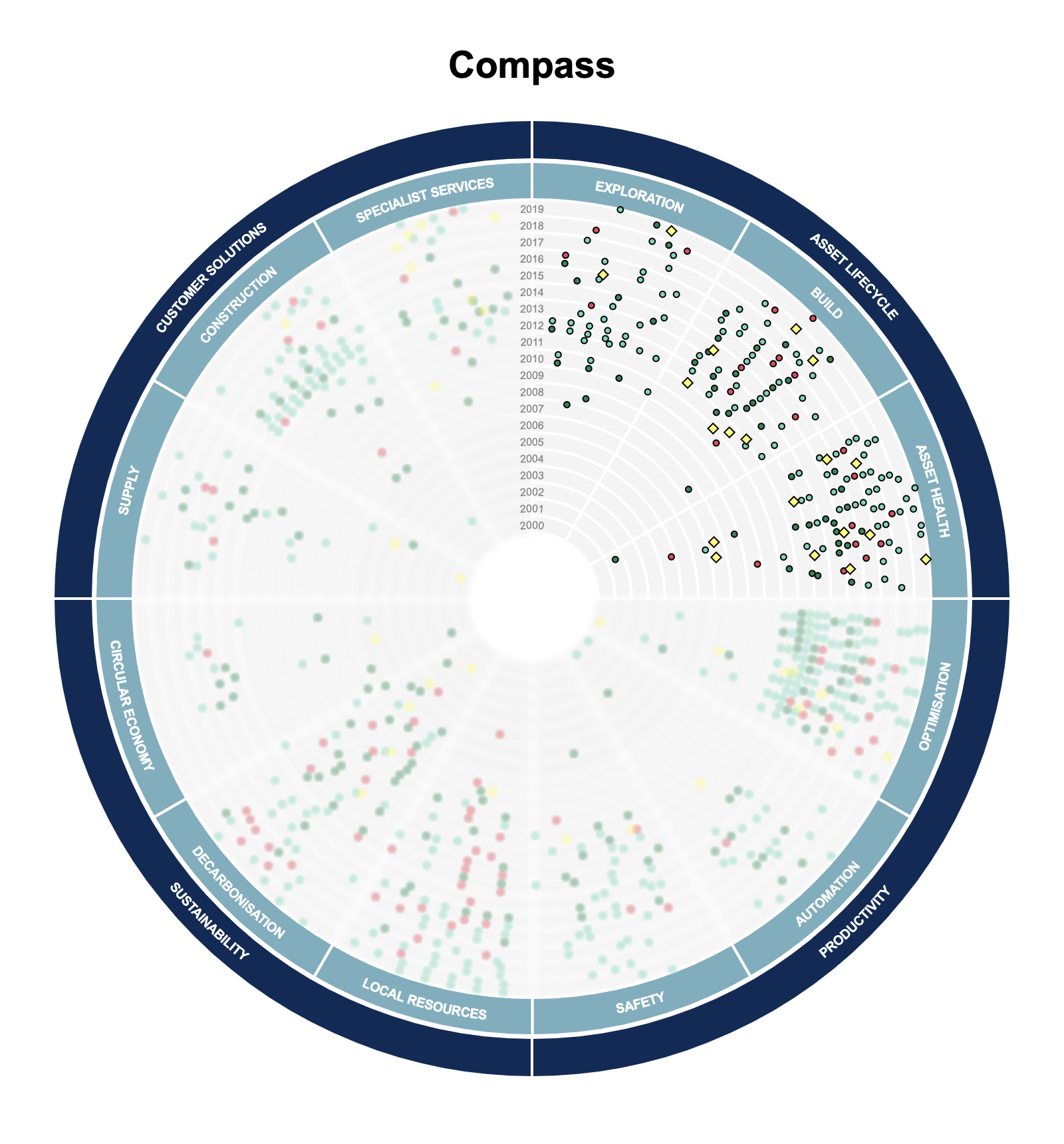

We recently worked with one of the world’s largest cement and mining companies, advising them on how best to move from supplying hardware to software. They wanted to identify the opportunities in digitisation for their business and then build the capabilities.

Predictive asset maintenance was one of the areas the leadership was keen to move into, and they initially felt strongly that they should build this capability themselves. Using our Compass tool, however, we were able to show them that this space had a high density of well-funded (Series B+) startups. Given that the company would have struggled to build its own tool, we recommended a series of startup partnerships and potential acquisitions that would help them enter this space.

This identified a clear pathway to unlock $3.25bn of new revenue and $50m of savings for them over the next three years.

The image shows the density and maturity (defined by fundraising stage) of startups and competitor activity that has been segmented by theme, then down to a more granular focus area. The density and maturity of the activity provide signals into the competitiveness of the space and the traction startups are getting to help inform companies on their approach if they want to move into this area, e.g. build/buy or partner. See more here.

Organisations need to shift from placing two to three large bets to running 30-40 smaller experiments.

Innovation can deliver when it is moved from being a series of projects into a core capability for the organisation. Organisations need to shift from placing two to three large bets on the future to running 30-40 smaller experiments using different vehicles with the focus on understanding which experiments to double down on and which to kill and extract the learning.

Corporates are in a position where accelerating rates of disruption and adoption are shattering the traditional business models. Transformation is no longer an option, it’s a necessity. But this shouldn’t be done blindly — the future cannot be risked on one or two big bets.

A data-driven approach cut through the uncertainty and identify what new areas a company should enter — and the best way to do it.