It's always a good sign when startups are oversubscribed at seed stage. Take Pipe for example — it raised a competitive $6m seed in Feb 2020 and 12 months later had secured a $2bn valuation.

So which young startups are investors lusting over in European fintech — a sector that's unrivalled in hype and investment? Who's stood out among the 200 European fintechs that have raised $234m in pre/seed funding so far this year?

We’ve asked a dozen investors to nominate the ‘sexiest’ seed rounds over the past 7 months, highlighting deals that were heavily oversubscribed or were especially competitive (including those they lost out on!). We also consulted Dealroom to identify the largest seed rounds across different subsectors.

The 25 startups below may not yet have a product, a C-suite or any publicity, but VCs agree they’re onto a winner. Several are based outside the UK and two are cofounded by women.

These are the young fintechs that got investors’ tongues wagging:

Payments

Osu

Business management and payments for self-employed

Seed funding: £2.3m (March 2021)

Lead investor: Creandum

Sunday

QR codes for restaurants to speed up check out time

Seed funding: €21.8m (April 2021)

Lead investor: Coatue

ScalaPay

Italian third party solution that enables customers to buy now pay later

Seed funding: €40m (Jan 2021). *Includes debt

Lead investor: Fasanara Capital

Tillit

Platform that combines invoice financing with a buy now, pay later model

Seed funding: €2.5m (Feb 2021)

Lead investor: Sequoia

Monovate

2 in 1 model for compliance and card scheme sponsorship platform

Seed funding: £5m (March 2021)

Lead investor: Anonymous US investor

B2B

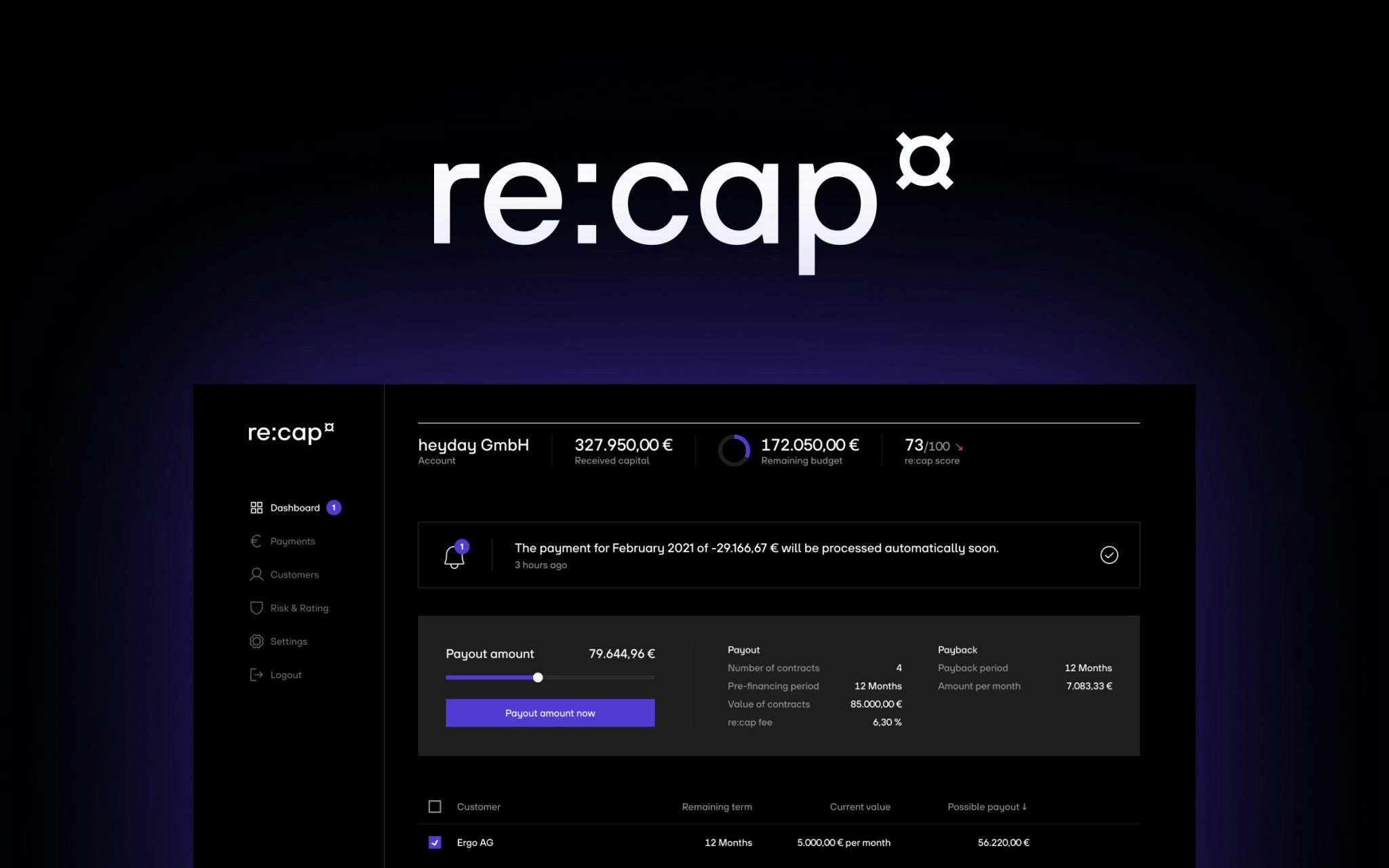

Re:cap

Berlin-based platform that allows subscription companies to get part of their revenue upfront by matching them with a lender

Pre-seed funding: €1.3m (May 2020)

Lead investor: Entrée Capital

Toqio

White label platform for banks to launch digital products

Seed funding: €8m (July 2021)

Lead investor(s): Seaya Ventures, Speedinvest and SIX FinTech Ventures

Airbank

Open banking platform that helps SMEs better manage their cash and financial data

Seed funding: €2.5m (Jun 2021)

Lead investor: New Wave VC

Weavr.io

Scalable platform to allow any company to add banking services via API

Seed funding: £7m (July 2021, extension)

Lead investor: Headline

LemonMarkets

Provides environment to build investing and trading tools for the stock market

Seed funding: n/a (Jan 2021)

Lead investor: Creandum

Consumer

Lightyear

Investment platform to better facilitate international trading

Pre-seed funding: $1.5m (June 2021)

Lead investor: Mosaic Ventures

StepEx

Finance solution aimed at postgraduate students

Seed funding: £1.1m (July 2021)

Lead investor: BBVA

Yonder

Challenger credit card

Seed funding: £4-5m (2021). Not yet publicly announced

Lead investor: Northzone/LocalGlobe

Hammock

Technology platform that will help landlords and letting agents manage properties.

Seed funding: £2m (Feb 2021, extension)

Lead investors: Ascension Ventures

Green finance

TreeCard

Fintech offering spending card made out of wood that funds reforesting as you spend

Seed funding: $5.1m (February 2021)

Lead investor: EQT Ventures

Minimum

API that embeds the option to allow carbon offsetting at checkout

Seed funding: $2.6m (June 2021)

Lead investor: Octopus Ventures

Insurance

Anansi

Risk protection for ecommerce businesses

Seed funding: £1.5m (July 2021)

Lead investor: Octopus Ventures

Bequest

Simplified wills and life insurance for the millennial market

Seed funding: £1.7m (July 2021)

Lead investor: Clocktower Ventures

Collective Benefits

Insurance, benefits and rewards fit for the future of work

Seed funding: £6m (July 2021)

Lead investor: NFX

Financial Education

Wajve

Gen Z financial platform bundling banking, advice and education into one app

Seed funding: €5m (June 2021)

Lead investor: EQT Ventures

ClearGlass

Allowing pension funds to discover exactly how much their asset managers are charging them

Seed funding: £2.6m (March 2021)

Lead investor: Lakestar/Outward VC

Crypto

Ramp

Open banking APIs to connect crypto with fiat, based in Poland

Seed funding: $10.1m (June 2021)

Lead investors: NFX and Galaxy Digital

GlobeDx

A crypto derivatives exchange where institutions and consumers transact digital currencies. Based across London and France.

Seed funding: €19.2m (April 2021, extension)

Lead investor: Y Combinator, Pantera Capital, and Draper Dragon

Rvvup

Next generation financial infrastructure bridging CeFi and DeFi for faster money movement

Pre-seed funding: $2m (July 2021)

Lead investors: HV Capital

Nayms

Insurance-based smart contract to provide coverage for digital assets

Seed funding: $6m (Jun 2021)

Lead investor: Coinbase Ventures, Spartan Ventures

Did we forget anyone? Email isabel@sifted.eu to chat!

Isabel Woodford is Sifted’s fintech correspondent. She tweets from @i_woodford.

Additional contributions by Tom Matsuda.