Venture capitalists love rocket ships. Not just the Elon Musk type, but any business that can return their investment a hundred times over.

Facebook’s market cap at IPO was roughly 200x its Series B valuation. Such growth is an exception, but those are the dimensions VCs think in.

Hopin’s Series B investors have a track record of spotting potential. Accel was part of Facebook’s Series B. The lead investors, IVP and Tiger, were early investors in Snap and Square respectively. Northzone backed Spotify and Salesforce Ventures invested in Snowflake.

When asked whether Hopin was one of those 100x opportunities, Alex Kayyal from Salesforce Ventures replies (as one might imagine) with an emphatic “Absolutely!”.

VC maths: how do they get to $2.1bn

A business is worth the sum of its future cashflows, discounted to their present value.

However, Hopin only has eight months of sales data, gathered during a pandemic that has sent work-from-home businesses soaring. A discounted cashflow model based on this data will return a precise, but likely wrong result as it is hypersensitive to the assumptions used.

Hopin’s investors will have arrived at its $2.1bn valuation as a multiple of revenue, checking against comparable publicly-listed companies.

Average revenue multiples for listed software-as-a-service (SaaS) businesses are at an all-time high, usually ranging from 10x to 20x. However, Hopin’s investors came in at a staggering 100x of the $20m annual recurring revenue (ARR) at the time of the Series B.

There are two main reasons for this.

Zoom, Hopin’s closest public market comparable, traded at a 96x trailing 12-months revenue multiple when Zoom announced its Q2 results (the most recent revenue data available at the time).

And even more important is Hopin’s average month-on-month growth rate since May of 50%. Hopin reached $20m ARR in 8 months. Zoom took about three years to reach the same milestone.

In software investing, five years to hit $100m ARR is the gold standard.

According to IVP’s general partner Jules Maltz: “Hopin is the fastest-growing company we have seen at this stage.” And growth is the single most important factor influencing SaaS multiples.

Many will doubt if Hopin can sustain its current growth rate after the pandemic, but it does not have to. “In software investing, five years to hit $100m ARR is the gold standard” says Alex Kayyal of Salesforce Venture.

If Hopin sustains its current growth rate for another four months, it will be at that point within a year. Or theoretically, its monthly growth rate could drop from 50% to about 3% and Hopin would still reach the $100m mark in five years, even though that kind of slowdown won’t be acceptable to investors, or founder Johnny Boufarhat.

Additional factors will have emboldened investors. The $1.1tn global events market is 40x the global music streaming market and can support several more unicorns. To get to $100m ARR, Hopin has to capture just 0.01%.

In addition, Hopin can probably show a credible path to profitability. The fact customers have been flocking to its platform organically ensures savings in marketing and sales, one of the main cost factors for SaaS businesses. It already claims 3.5m users, has worked with 50,000 organisations since March. Without physical offices, its overheads will be low too.

Lastly, the exact price of the highly competitive round will have been set by supply and demand. “If there was only one investor who wanted to invest, the price would be lower,” says Paul Murphy from Northzone, “but a lot of people wanted to invest in Hopin.”

Investors, seeing huge upside potential (and often motivated by FOMO), probably feared missing out on getting a seat on the rocket ship rather than overpaying for their ticket.

Could VCs be off the mark?

Hopin’s valuation is aggressive, but comprehensible provided SaaS revenue multiples stay where they are. For many investors like Tiger, which raised a $3.75bn fund this January, the Hopin investment is relatively small and of limited risk. Valuations are art as much as science though and several factors could spoil the picture.

Competition will increase. Hopin can be copied. Just last week Bizzabo, an Israeli-born events platform, raised a $138m Series E funding round led by Insight Partners. Zoom’s CEO Eric Yuan might be scratching his head wondering if he is missing out. Such competition can slow growth and be costly as it can force companies to lower prices and increase marketing spend.

Users, particularly those with a month-on-month subscription, could churn and switch to another platform. In May, Hopin’s gross churn was 11% a month, according to Boufarhat, but Murphy is not worried: “Early churn was noise. In the long run, we expect retention in the range of top tier SaaS companies.”

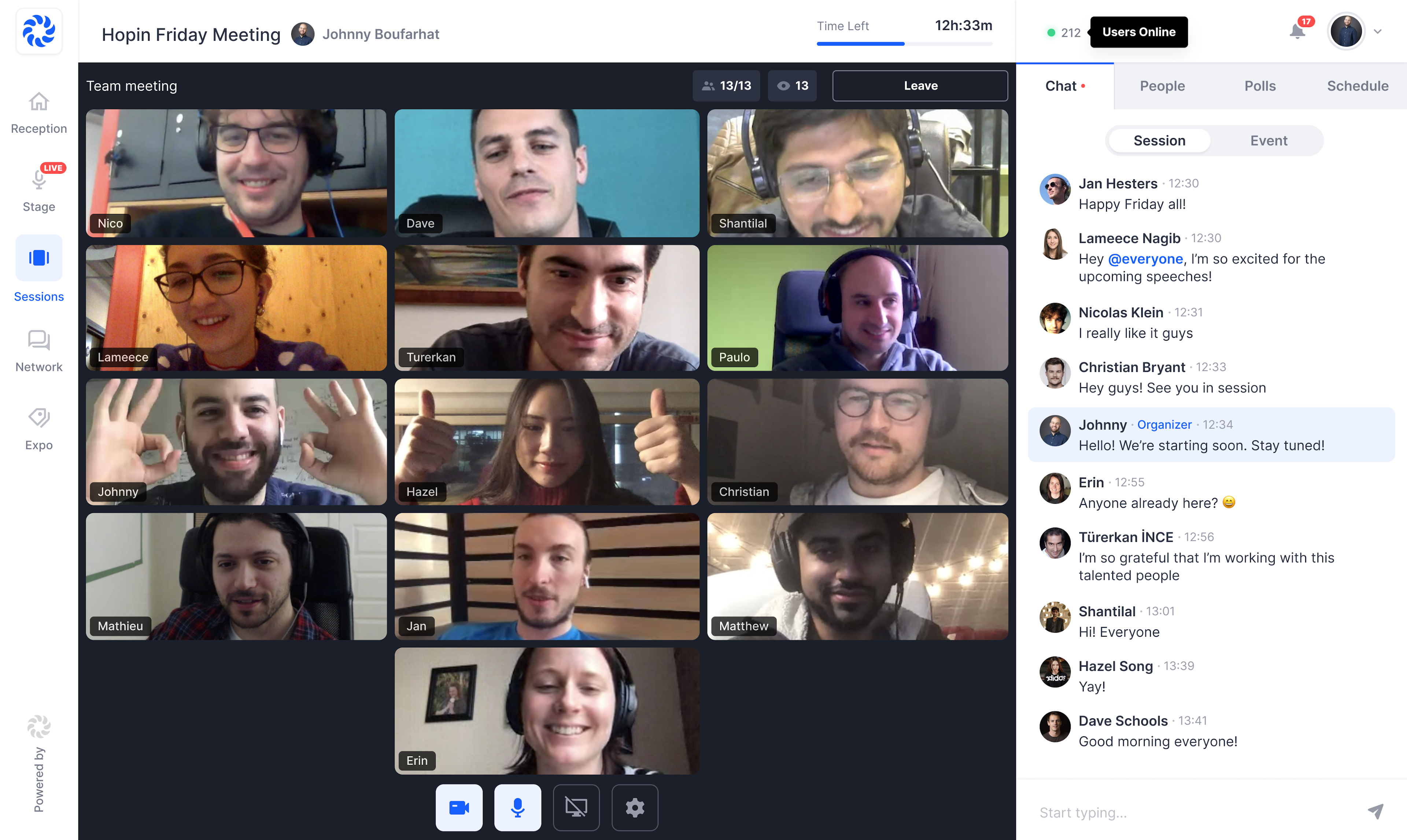

Hypergrowth might put too much pressure on employees, systems and corporate functions. Things always break. Over the coming months, Hopin will have to perform both a land grab and build a moat around the business. Boufarhat, as a first-time founder, will attempt it with a fully remote workforce, scattered across the globe.

Hopin has the market, product and opportunity to become a hugely successful business. Given its unprecedented growth rates, investors felt confident that it would grow into its valuation rapidly. But Zoom’s quarterly results this week provide pause for thought. Despite sales growth, Zoom’s share price fell by more than 10% following the announcement, showing that some investors had hoped for even more from the work-from-home economy.