Ask the average Brit what the current price of Apple stock is and the vast majority will draw a blank. For all the talk of the UK as a financial powerhouse, its population has not yet embraced retail investing.

But change is on its way in the UK and across Europe, where local entrepreneurs raked in a healthy chunk of the $761m raised globally by wealthtech firms in the third quarter of this year.

That includes retail-trading startups like Germany’s Trade Republic, 99 in Spain, Holland’s Bux, and the UK’s Freetrade. Investment-education startups like Finimize and Reitly have also emerged to enlighten people before they sign up to a neo-broker.

Perhaps most importantly, Robinhood — the giant US-stock trading app — has now selected the UK as its next home and is set to launch there in the first quarter of next year. The company, which has amassed over six million US users with its transformative zero-fee offering, announced last week that it had opened its UK waiting-list.

Robinhood's UK president, Wander Rutgers, told Sifted that the company wants to target "underserved" first-time traders, hoping to match their success among millennials in the US. Eventual expansion into the continent seems like an inevitable next step.

Should Europe's wealth apps be worried?

While Europe's “invest-from-your-sofa” tech space is still nascent and Robinhood is a giant player, the pending launch in the UK generally shouldn’t frighten existing players.

Robinhood's brand-recognition and $862m in venture capital mean it is well positioned to bring Europe’s attention to savings and investment.

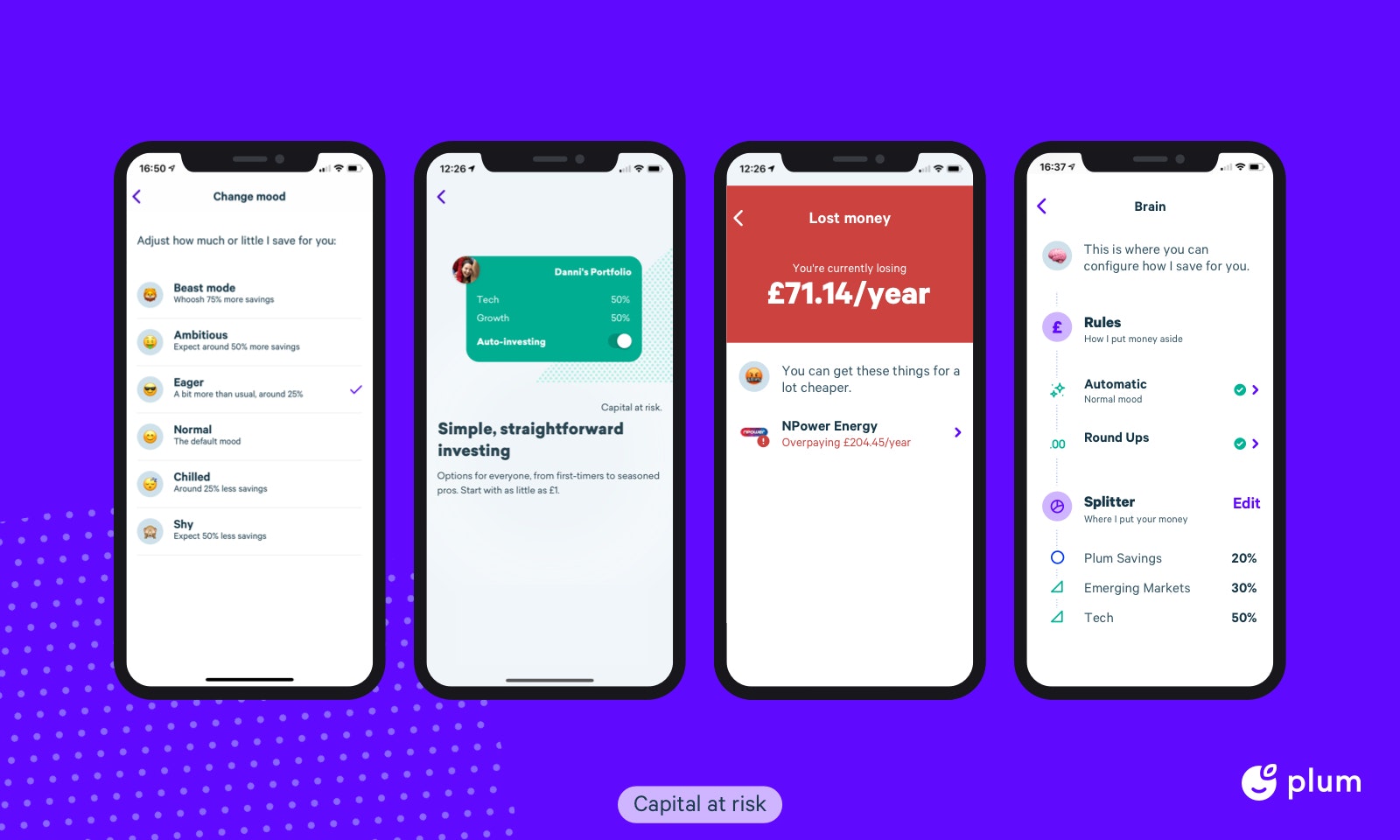

Indeed, its marketing techniques could make retail investing less alien to Europeans, while raising the profile of less risky (and perhaps more attractive) local wealthtech startups such as Plum, Dreams and Tickr.

To this point, Sifted has heard that Robinhood has already agreed to a paid partnership with a UK investment startup as part of its customer acquisition strategy. This shows its readiness — at least for now — to actively engage with and boost the local ecosystem.

Indeed, Freetrade chief executive Adam Dodds agrees that the newcomer isn't a catastrophic threat.

“Anytime you have a company with a $7bn valuation sure [it’s competition]. But there were already multiple alternatives to Freetrade, we didn’t have a monopoly,” he told Sifted.

“Let’s see how the American does,” Dodds quipped.

Indeed, the UK startup has already survived the launch of Revolut’s in-app trading platform (now headed by Andre Mohamed; a former Freetrade employee who was allegedly fired).

"Revolut's trading launch has been a non-event," Dodds noted.

Freetrade has seen reasonable success since then, having secured an FCA license, closed a $15m Series A and on-boarded 70,000 users, who have collectively deposited tens of millions of pounds. It also currently sits comfortably with a 4.7 rating on TrustPilot, beating eToro - its most-akin but larger rival, which has a 2.8.

Robinhood also faces some limitations when it comes to attracting first-time users. For one, Robinhood will only offer US-listed stocks and trade exclusively in dollars, while Freetrade trades directly in pounds and mainly offers UK shares. Dodds believes this will have more appeal domestically (“people want to buy what they know”). Secondly, Freetrade locks-in trades once a day rather than in real-time. This is to dissuade opportunistic (arbitrage) trading, while encouraging cautious investors to make monthly contributions to a small portfolio.

“We try and encourage people to buy and hold,” Dodds noted.

“It’s a bit shocking that so many people are losing money when the market is at an all-time high, while these guys [companies] are making money. They encourage you to trade too much.”

By way of reference, eToro flags on their website that 75% of its investors lose money betting live on CFDs (synthetic shares).

Nonetheless, Robinhood also has certain advantages, including a tried-and-tested tech solution, more features, and a competitive brokerage scheme. In comparison, industry players privately question whether Freetrade can “cope” with masses of new users. Meanwhile, Revolut could well turn into a threat of its own, already claiming to have 100,000 trading users signed up (although it’s unclear how many are active).

Overall though, Robinhood's expansion into Europe offers a necessary profile-boost to the continent's growing offering of investment startups. Indeed, attracting the masses to investing will be key to the viability of Europe's main wealthtech players, whose profit models have been much changed by zero-fees becoming the norm.

"Investing in the UK is a bit of an old boys’ club for people with lots of cash, so having somebody else...making investing more accessible is always welcome," eToro's UK managing director, Iqbal V. Gandham, told Sifted.

Robinhood's prevalence could also bring awareness to other low-risk investment startups, included France's Cashbee or automated-savings app Chip. Of course, Robinhood poses serious competition on some level but if the American giant can survive in the UK it will also elevate its (smaller) neighbours.

So, true to its name, Robinhood could be a blessing in disguise.