2021 was a memorable year for female entrepreneurs. In the US, Bumble’s Whitney Wolfe Herd became the youngest woman ever to take a company public — photographed ringing the market bell with her infant son wedged proudly on her hip. 23&me and Spanx also secured exits which made their female CEOs billionaires.

While not quite as headline grabbing, women in Europe also had a record year — 2021 saw more "successful" female-led exits than ever, hitting 23 in total, according to Sifted research.

At least 87 female cofounders have overseen successful exits in the past 15 years across Europe, including 19 female-led IPOs.* The continent shouldn't declare the patriarchy defeated too soon though: the number of successful male-only exits in the same period totalled 899.

This analysis was conducted by Sifted, drawing on Dealroom data. We only counted female entrepreneurs who’d exited for over €20m via IPOs, buyouts or acquisition since 2005, as a proxy for "success". As not all companies disclose their exit price tag, we also counted companies whose last valuation before being sold stood at €20m or above. We included startups with at least one female cofounder.

What the data tells us

There are other interesting nuggets within this European dataset of female exits:

- The average amount of time for a top female exit is 6.8 years.

- Collectively, the value of Europe’s female exits since 2005 totalled €22.3bn, largely fuelled by the IPOs.

- The average acquisition was priced at €218m, based on the handful of exit valuations that were public.

- The sector most populated by female exits was healthtech, followed by fintech.

- The largest IPO was BioNTech; the largest disclosed acquisition was Ganymed Pharmaceuticals at $1.25bn — both were founded by Özlem Türeci.

- Apple has acquired several female-led companies in Europe. In 2011, it bought Barcelona-based Vilynx for around €40m, cofounded by Elisenda Bou. Then in 2015, it bought music & social data analytics startup Semetric for about $50m, cofounded by Marie-Alicia Chang.

- The UK leads the pack — in line with the fact it also attracts the most funding

Nonetheless, while the UK saw the most female-led startup exits in Europe, just 15% of UK high-growth businesses since 2011 had a female cofounder, according to Beauhurst. Meanwhile, just 10% of British IPOs counted a female founder, and of the largest 20 IPOs ever in the UK, only two were by female-founded companies.

- Europe is behind the global stats. Female-led exits accounted for around 3.8% of all European exits of companies founded after 2000; the global figure stood at 5%, while the US counted 5.8%.

- Globally, the Dealroom database shows that 584 female-led startups have "successfully" exited in the same period. The US counted 395 female-founded exits worth over €20m in the same period.

Winning women: Top 10 (by known exit value)

It's also worth flagging the 10 women who’ve overseen the largest exits in Europe since 2005.

The ranking, per Dealroom’s data, goes as followed:

1/ Özlem Türeci

Company: Ganymed Pharmaceuticals; BioNTech

HQ: Mainz, Germany

Year of founding: 2001; 2008

Year of exit: 2016; 2019

Exit details: $1.4bn acquisition by Astellas Pharma, $150m IPO ($3.4bn valuation)

Fellow cofounders: Uğur Şahin, Christoph Huber

2/ Andrea Spezzi

Company: Orchard Therapeutics

HQ: London, UK

Year of founding: 2015

Year of exit: 2018

Exit details: $200m IPO ($1.3bn valuation)

Fellow cofounders: Bobby Gaspar

3/ Pernilla Nyrensten

Company: RevolutionRace

HQ: Borås, Sweden (First woman to list on the Stockholm Stock Exchange)

Year of founding: 2013

Year of exit: 2021

Exit details: $1bn IPO

Fellow cofounders: Niclas Nyrensten

4/ Ilise Lombardo

Company: Arvelle Therapeutics

HQ: Zug, Switzerland

Year of founding: 2019

Year of exit: 2021

Exit details: $960m acquisition by Angelini Pharma

Fellow cofounders: Gregory Weinhoff

5/ Ekaterina Malievskaia

Company: Compass Pathways

HQ: London, UK

Year of founding: 2016

Year of exit: 2020

Exit details: $544m IPO

Fellow cofounders: George Goldsmith, Lars Christian Wilde

6/ Romina Savova

Company: PensionBee

HQ: London, UK

Year of founding: 2014

Year of exit: 2021

Exit details: $85m IPO ($550m valuation)

7/ Annegret Baey-Diepolder & Christine Schuberth-Wagner

Company: Rigontec

HQ: Bonn, Germany

Year of founding: 2014

Year of exit: 2017

Exit details: $525m acquisition by Merck

Fellow cofounders: Gunther Hartmann, Marcel Renn

8/ Sarah Gilbert

Company: Vaccitech

HQ: Oxford, UK

Year of founding: 2016

Year of exit: 2021

Exit details: $110m IPO ($464m valuation)

Fellow cofounders: Adrian Hill KBE

9/ Mai-Britt Zocca & Inge Marie Svane

Company: IO Biotech

HQ: Copenhagen, Denmark

Year of founding: 2015

Year of exit: 2021

Exit details: $100m IPO ($388m valuation)

Fellow cofounders: Mads Hald Andersen

10/ Elvire Gouze

HQ: Basel, Switzerland

Year of founding: 2014

Year of exit: 2019

Exit details: $340m acquisition by Pfizer

Fellow cofounders: Luca Santarelli

Notable mentions

- Jessica Nilsson, Navina Pernsteiner and Chloe Macintosh were cofounders of HelloFresh, Sono Motors and made.com respectively, but all left their companies before the exits.

- Poppy Gustafsson is CEO of Darktrace, overseeing a $2bn IPO last year, but is not technically a founder. Other prominent executives overseeing their company's exit were Nicole Eagan and Cathy Graham.

- Other women to note are those whose companies exited but were founded before 2000 (hence outside our criteria). They include the founders of TomTom (founded 1991, exited 2005), Neopets (founded 1999, exited 2005) and Bodas.net (founded 1995, exited 2015).

The next generation

The data reveals a tiny number of female exits over nearly two decades. That should come as little surprise given the pace of early-stage investment in women in Europe.

Last year, just 1.1% of Europe’s venture deals went to all-women founding teams, according to Dealroom. The lack of funds raised by women is not only linked to their number of exits, but also to their size.

-

Read more: Which VCs are backing the most women?

Nonetheless, a new wave of female exits could be on its way in Europe. 2022 is already off to a good start, with French ready meal delivery company Frichti — founded by Julia Bijaoui — being acquired by Gorillas.

Meanwhile, 25% of the UK’s high-growth companies today have a female founder, according to Beauhurst, with the highest concentration based in Scotland. Among the top bets is Starling’s Anne Boden, who's hinted she's considering taking her fintech unicorn public this year.

Moreover, the next women-led exits could be disproportionately large relative to the amount raised.

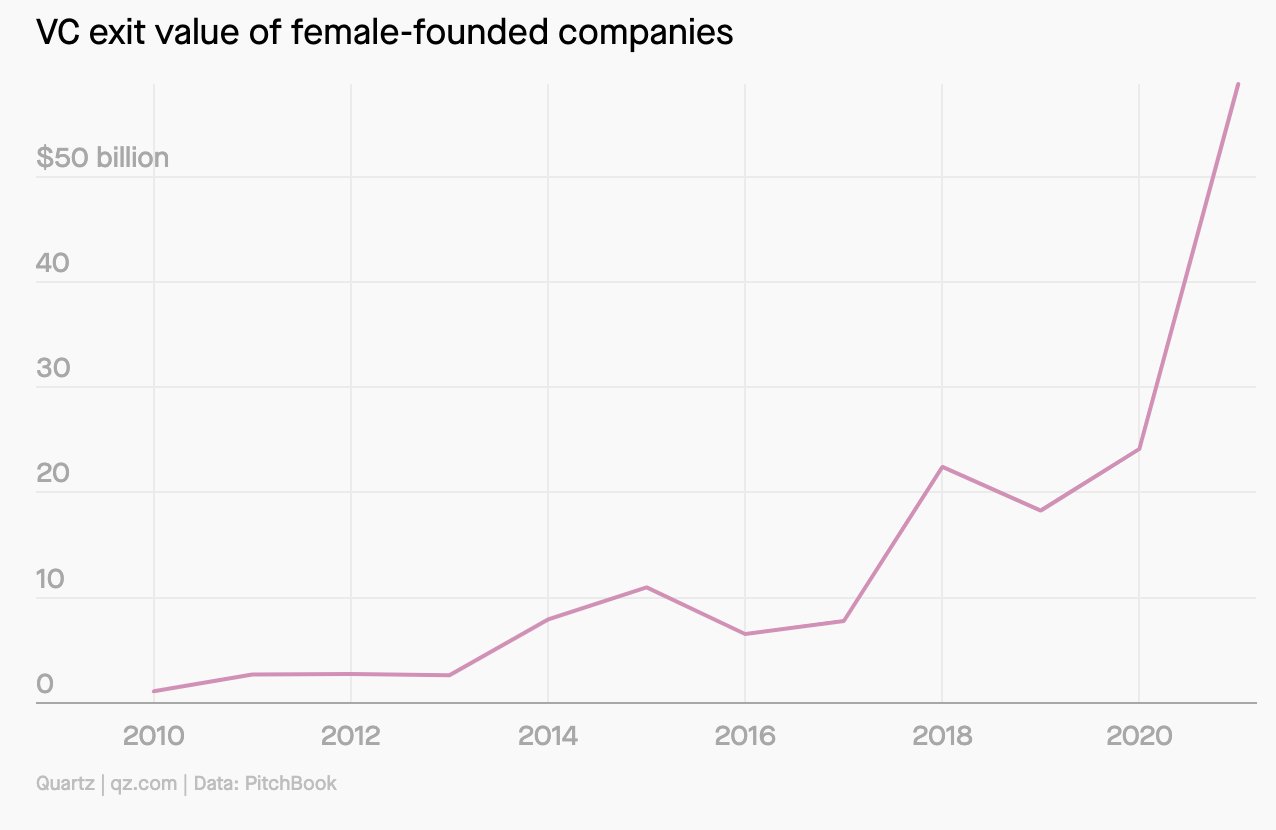

Indeed, across 2019 and 2020, a Pitchbook analysis of US startups found that "the female CEO exit value soared 30%, while the male CEO figure plummeted 44%". In other words, women are not only quicker to exit, but are rapidly closing the value gap with men.

When it comes to funding, the VC “boys club” is also slowly being dismantled. Last year, Europe welcomed a series of funds exclusively dedicated to women, including the UK's Pink Salt Ventures and Auxxo in Germany. They say their ambition is to fund the next generation of “self-made female billionaires” who grow — and then sell — standout businesses.

In addition, there’s a campaign spearheaded by Polish VC Kinga Stanislawska to get the European Commission to dedicate €3bn to female-led venture firms.

Top of its list could be Europe’s growing pool of second-time female founders, who have already proven themselves. Among them are Kim Nilsson (who previously ran Pivigo), Riya Grover (who previously ran Feedr), Alicia Navarro (who previously ran Skimlinks) and Sophie Adelman (who previously ran Multiverse).

Other resources

- In the US, the exit value of female-founded companies is growing, hitting $60bn last year

- Global successful female exits, before 2020 — Among them are Japan’s Victoria Tsai, who sold her company tatcha, and Katrina Lake, who founded clothes company StitchFix.

***

*A note on methodology

- Headquartered in Europe

- Launched in or after 2000 (to account for long-term exit iterations)

- Have at least one female founder

- Exited at €20m+

- If no exit, then valued at €20m+ at the last funding round

- Exited through one of: IPO, acquisition, buyout