On an industrial estate just outside Crawley, a town in the southeast of England, a team of engineers are busily working on an invention that they say could literally propel the country towards its net zero targets.

Bramble, a spinout from University College London and Imperial College, is redesigning the hydrogen fuel cell.

Fuel cells convert hydrogen into electricity, and can be used in EVs, other forms of transport and in batteries. They also have the potential to power things like heating too. Depending on how the hydrogen is produced, fuel cells can offer a renewable source of clean fuel.

“Hydrogen is desperately needed as part of the transition to a net zero economy,” says Dr Tom Mason, who worked on a PhD researching hydrogen before becoming CEO of Bramble.

“But it must be clean, green and fast. One of the main reasons hydrogen is an important piece is its versatility as an energy vector. It's only emission is water, providing green energy to consumers and limiting particulates that are released into the air.”

Current fuel cells are cumbersome and extremely expensive but Bramble is working on a modular system that will reduce their size and cost, paving the way for their use in cars — the company’s founders are already driving hydrogen-powered ones.

The fuel cells could be particularly helpful for long-haul transportation, where charging electric batteries with enough power can be difficult.

Bramble is part of a wider industry gathering pace in Europe, working to build the “hydrogen economy”.

In 2021, the continent’s hydrogen startups, those working on hydrogen vehicles, fuel cells, storage and electrolysis, brought in $437m in funding — a 592% increase on 2020’s figure. And just two months into 2022, this year’s total has already surpassed 2020’s.

Like a lot of the alternative energy industries, funding in hydrogen has risen on the back of surging interest in energy sovereignty, particularly after Putin’s invasion of Ukraine and a desire within Europe to shift dependence off Russian oil.

Its backers also push its green credentials, and say it can be a key component in the transition to net zero. Hydrogen is a clean fuel — water is its only byproduct.

Sceptics, however, say that the energy required to produce hydrogen is greater than the energy it provides or saves. It’s also true that the vast majority of hydrogen production at present uses fossil fuels — so the industry would need to transition to using renewable energy in production to be classed as a totally clean fuel.

Green, blue and grey hydrogen

Although using hydrogen doesn’t create any emissions, producing it can. Hydrogen molecules aren’t found on their own in nature, so to isolate them to use as fuel, they have to be split apart from other molecules. It’s a process that requires a lot of energy.

Green hydrogen uses renewable energy sources to separate out the oxygen and hydrogen from water, in a process known as electrolysis. It means producing a clean fuel using a renewable method; though green hydrogen only accounts for 0.1% of hydrogen produced.

Grey hydrogen is the most common, accounting for about 90% of all hydrogen produced. That’s the process that relies on fossil fuels: natural gas and methane are used in a process known as “steam reforming”.

Blue hydrogen is similar to grey, but includes carbon capture and storage (CSS) to collect emissions produced in the process. Some argue that makes it a “low carbon” fuel, though it’s estimated that at least 10% of emissions can’t be captured.

The resulting hydrogen can be used either as a gas or transformed into a fuel.

Startups are working on hydrogen for steel production, chemical production and refineries, as well as for transportation — in cars, trains, buses, ships and planes — and in power generation and heating too.

They’re working across the hydrogen lifecycle, trying to improve production and storage as well as generation.

Using data from Dealroom, we’ve mapped them. These companies have all raised funds in the last five years.

Startups working on hydrogen production

Startups are working on improving the tech to improve the electrolysis process, which is how green hydrogen is produced.

The biggest startup in the space is German company Sunfire, which is working on a pressurised Alkaline electrolyser.

Here are the others:

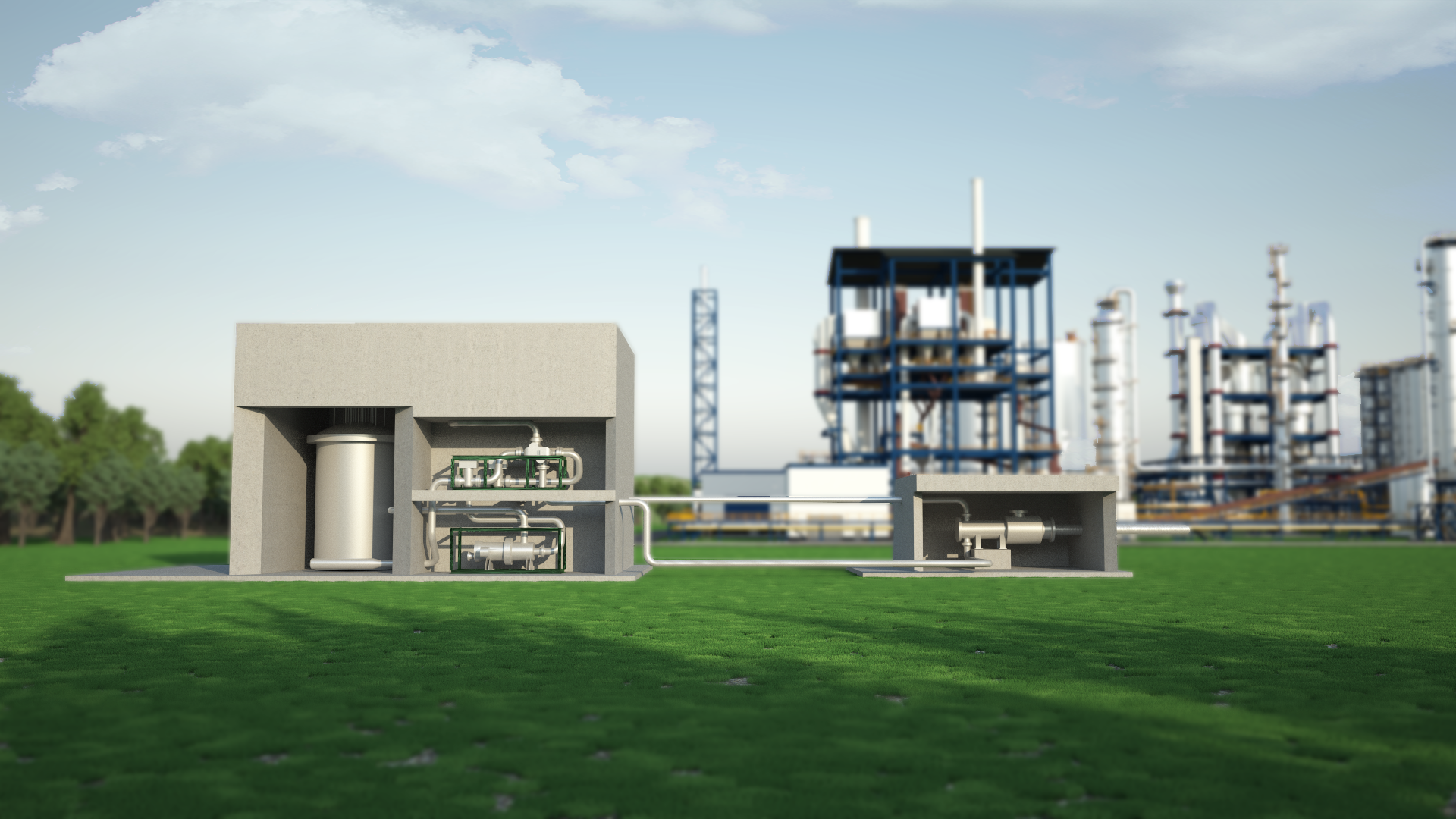

Startups working on hydrogen storage

The next part of the process is storing and transporting hydrogen. It can be stored as a gas or a liquid. The gas requires high-pressure tanks and the liquid requires cryogenic temperatures, because the boiling point of hydrogen is very low.

Several European startups are working on improving the storage tech for hydrogen:

Startups working on hydrogen fuel cells

Fuel cells convert chemical energy, including hydrogen, into fuel. They can be used in cars and other transportation, as well as to power anything that runs off a battery. Bramble are one of Europe’s startups working on the tech.

Here are the others:

Startups working on hydrogen vehicles

Several European companies are working on hydrogen-powered vehicles, including taxis, planes and cars. Big corporates are also working on the tech: Airbus, for example, is developing a hydrogen-powered plane.

Here are the startups: