Europe’s first- and second-tier startup hubs are growing the fastest, pulling away from their smaller rivals, according to a Sifted analysis of Dealroom data.

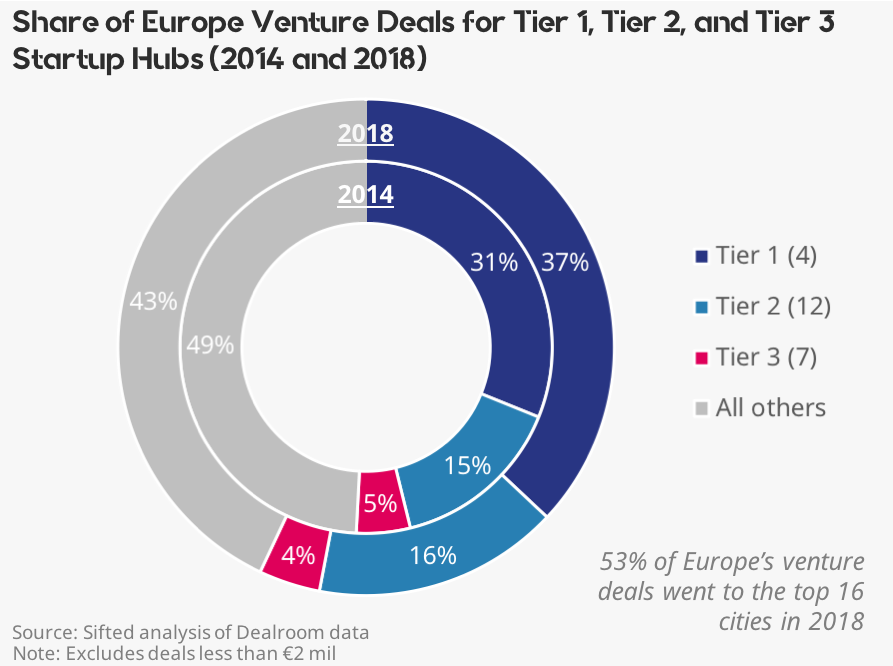

In 2018, Europe’s four leading startup hubs—London, Paris, Berlin, and Stockholm—collectively accounted for 37% of venture deals worth at least €2m. That’s up from 31% in 2014.

The remaining startup hubs, as a group, lost ground. That’s the main takeaway from Sifted's Chart of the Week in partnership with Dealroom.

Combined, the sixteen Tier 1 and Tier 2 cities now account for 53% venture deals in Europe, up from 46% in 2014.

This follows a global trend over the last decade, which shows that although more cities than ever are participating in the venture-backed startup economy, the leading cities are growing even faster, and pulling away from the rest.

But the smaller hubs are still mostly growing in absolute terms as Europe's whole startup ecosystem is growing, as can be seen in this date here and here.