Europe is well known for being the world’s leader in digital tech regulation.

First, the region introduced world-first data protection rules, then decided on policing online platforms. And in May, EU lawmakers passed the landmark Markets in Crypto-Assets (MiCA) law, legislation five years in the making that aims to set clear rules for cryptocurrency firms. It’s a marked contrast with the approach of US President Joe Biden’s administration, which has focused on regulation by enforcement.

Crypto founders and investors say that having clear digital asset regulation is helping Europe attract more crypto investment and talent. As the US Securities and Exchange Commission turns up the heat on crypto, firms like Revolut are pulling crypto offerings from the world’s largest economy.

So what do companies need to know about the legislation? And will it succeed?

1. Get started with an application now; it will take a few months

MiCA requires crypto firms actively targeting European customers to meet various standards for consumer protection, segregation of funds and even customer complaints, as so-called crypto-asset service providers (CASPs). It also divides cryptocurrencies into three separate categories with specific rules on stablecoins — cryptocurrencies pegged to a fiat asset like the US dollar.

In exchange, the regulatory status enables firms to operate across the entirety of the union with just one licence.

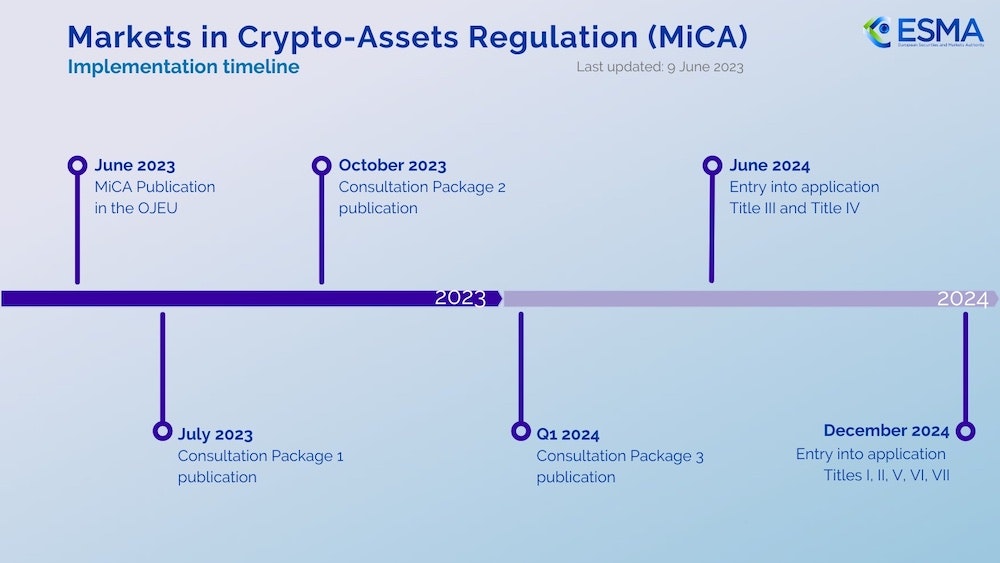

While MiCA officially came into force in June, it will only be implemented by the end of 2024, which is when applications are due to be filed to national regulatory bodies. Crypto companies are expected to already start preparing even though the European Securities and Markets Authority (ESMA) is still in the consultation stages on some of its more technical rules.

In July, ESMA unveiled its first set of detailed crypto rules covering user complaints and conflicts of interest. Key guidelines on sustainability and record keeping, and when to class crypto as a security, will be unveiled in October and early next year respectively.

That might seem like a lot of time, but startups should get started on the application now, say lawyers and investors.

Yannis Heyken, chief operating officer of Cherry Ventures’ crypto fund, notes that while MiCA is a bloc-wide licence, national regulatory bodies will be in charge of the application process, which could mean companies will face different processing times.

“Putting the application together already takes a couple of months and then when you hand that to the regulator, it’s dependent on the national regulator how quickly they progress it,” he says.

2. Each EU member state will have its own quirks

Each of the 27 EU member states is likely to have varying levels of competency and experience with digital assets.

In France, those that are registered with the local regulator are granted an extra 18 months for the MiCA application, but in Belgium, this isn’t possible, says Kevin de Patoul, founder of crypto market maker Keyrock.

The head of the SIX Fintech-backed firm also said it’s unclear which authority in Belgium will take charge of the application process. While de Patoul stressed that this was the normal course of action compared to previous regulatory rollouts in the country, he’s keen to get the ball rolling.

“My worry is not on us being ready, it’s on the length of discussions,” he said.

On the opposite side of the spectrum, startups that have only thus far registered in more lenient EU jurisdictions might be in for a nasty surprise when it comes to applying for MiCA.

“Some companies have decided to choose jurisdictions with simplified registration processes,” says Daniel Arroche, partner at blockchain law firm D&A Partners. “But there may be challenges as there’s a large gap between gaining approval in these jurisdictions and attaining compliance with MiCA.”

Arroche highlighted Malta, Lithuania and Spain as examples of jurisdictions with less regulatory complexity compared to France, Germany and Italy.

3. NFT and DeFi companies should be extra careful

There are also noticeable gaps in MiCA regarding the non-fungible token (NFT) and decentralised finance (or DeFi) space. DeFi relies on blockchain technology to enable access to financial products that aren’t controlled by a single intermediary.

“Companies in the NFT and DeFi space have to be very careful,” says Arroche. “If an NFT is part of a huge collection, for instance, it can be considered a fungible instrument, therefore covered by MiCA.”

MiCA judges that DeFi falls out of its scope as long as projects are fully decentralised. Such projects typically decentralise by distributing tokens that enable governance powers to a larger swath of users.

At crypto lender Genesis, many such projects, however, are centralised in nature. Cherry Venture’s Heyken is actively encouraging such portfolio projects to fully decentralise as a fail-safe to meet the end-of-2024 deadline.

Heyken believes it’s unlikely that regulators will go after such projects with DeFi currently not being a core focus of MiCA.

Hopeful?

Despite these challenges, most of the crypto industry veterans that Sifted spoke to say they have high hopes for MiCA, especially when compared to the US approach.

Samantha Bohbot, chief growth officer at the Prague-based crypto fund RockawayX, says that the lack of regulatory clarity will ultimately cost the US talent. Bohbot herself left the US after leading growth efforts at crypto conglomerate Digital Currency Group, which owns exchange Luno and beleaguered crypto lender Genesis.

“Part of joining a firm in Europe was that I see a shift in the industry of talent moving to Europe,” she says. “It’s hard enough to build a company, but to build it in an uncertain operating environment is just sometimes too much stress.”

For Bohbot, MiCA is a “vote of confidence” for crypto in that it shows that EU governments care enough about it to roll out a dedicated regulatory framework.

“It’s a signal that the governments here believe the crypto industry has staying power; it serves a role in innovation and contributes to our economies,” she says.

There are promising signs that MiCA might be having a positive effect on investor sentiment for the continent. In the second quarter of this year, Europe accounted for 48% of all VC funding to crypto startups.

There continue to be unknowns about the MiCA application process on local levels and the regulation’s impact on DeFi and NFTs, if any. But Keyrock’s de Patoul says although there are clearly things that are missing, he’d rather lawmakers didn’t address certain topics than deal with them inadequately.

“Will MiCA be the standard for digital assets for the next 10 years?” says de Patoul. “No, but it’s an excellent first basis. As with any first directive, Europe is going to consistently iterate on it to make it more suitable for the market.”