Europe’s top challenger banks saw a drop in digital downloads last month in a sign that the coronavirus lockdown may be negatively impacting business.

Monzo, Revolut, Starling and N26 saw their growth rate drop by between 18% and 36% in their native markets*, according to an analysis by Priori Data commissioned by Sifted.

This comes despite speculation that they would draw in new audiences during the lockdown because these companies specialise in online banking.

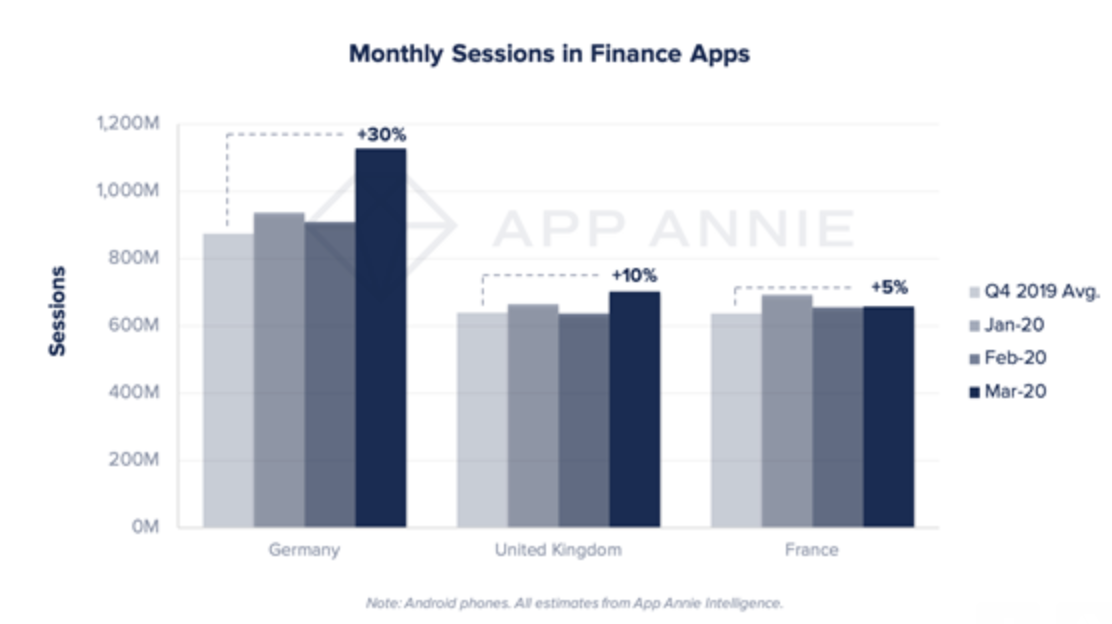

It also comes as other finance apps have seen increased adoption, with analytics company App Annie showing a 10% increase in usage in the UK between March and the end of last year, along with a 30% increase in Germany.

Fluctuations are normal for digital banks, but March showed a marked drop in new downloads compared to February - as shown below - and from the same time in 2019 (when the growth rate was positive across the board).

Meanwhile, smaller neo-banks across Europe are reporting the same slowdown.

Spain's BNext told Sifted the virus had "affected [them] a lot", observing a 30% drop in monthly active users (many of whom are travellers), as well as a large drop in transaction volumes.

A leading French neo-bank, which preferred not to be named, also said it had seen a drop in new card orders.

The exception to the rule seems to be neo-banks in Sweden, where there has been a less severe lockdown. Local challenger PFC, which launched in 2018, says it's not only sustained transaction volumes in March but also saw a "steady" increase in growth for consumer acquisition.

Reading the data

It would be wrong to rush to any absolute conclusions yet.

Firstly, the top four neo-banks slowed rather than stopped growing; they still welcomed between 20,000 and 149,000 downloads last month in their local-markets (more than most traditional banks in raw numbers). Additionally, most startups have cut their marketing spend to preserve their runways, which will be contributing to the slowdown.

But this data does raise questions about digital banks' assumed advantages at this time, their organic growth rate and why they aren't the logical home for locked-down users.

"The thesis around digital behaviour has long been that convenience trumps trust and security. But we'll need to ask now if that is still the case," Northzone's Jeppe Zink told Sifted.

"I imagine they [neo-banks] will lie low this year. They'll want to take 2020 out of the calendar."

In theory, retail digital banks should be leveraging their remote onboarding systems and seeing improved growth amid branch closures. This seems to be the case in the US at least, where local neo-bank Chime says it saw a record day of signups this month, prompted by their approval to distribute federal stimulus packages.

The slowdown in Europe therefore comes as an unexpected growth blip, which could continue for the duration of social distancing. It also raises concerns about digital banks’ advantages over traditional players and their vulnerability as ‘spending’ accounts.

"This [virus] will shake the tree,” a former digital bank employee told Sifted.

Although downloads do not directly translate into revenue, growth is a key metric for this category of fintechs (who have monthly burn rates in the millions). That means a continued slump alongside a slow recovery could have serious consequences, says fintech-advisor Alessandro Hatami, a former executive at Lloyds.

"It all depends if this is a sharp V-shaped crisis or if we will have a sharp decline followed by a slow bumpy recovery," he said, noting the latter would prove dangerous.

Monzo and its peers also seem to be preparing for a sustained revenue crunch, taking serious cost-cutting measures. Revolut, Monzo and N26 have all cut senior salaries, while the latter two will also furlough or reduce the working hours of over 150 employees each.

Long-term gains?

For now, the data shows the pandemic has seemingly slowed neo-banks' efforts to take market share, as predicted by Sifted last month.

But Stefan Klestil — an investor in N26 — argues the current slowdown is down to "shock", which makes opening or switching bank accounts a last priority.

"This [slowdown] doesn't contradict the general thesis around digital adoption. We do expect to see that grow exponentially in the mid-term, maybe in six to 12 months," he told Sifted, adding, however, that an immediate recovery was unlikely.

Several other fintech investors Sifted spoke to said that incumbent banks may struggle to keep up operations amid the remote working. That could prompt a late surge for digital-first banks in the coming months.

"Already, I'm seeing friends my age jumping ship to N26, seeing the benefits [over incumbents]," says Klestil.

But there is another argument. The lockdown could incentivise incumbents to catch up with the neo-banks on the digital front.

For instance, Barclays has already introduced a "Banking from home" digital hub in response to the lockdown and has introduced remote onboarding.

One major UK incumbent also confirmed to Sifted that they'd seen an uptick in mobile logins since the lockdown began. Although this is likely made up of existing customers, it illustrates an opportunity to bridge the digital gap.

Additionally, traditional banks could use their marketing budgets to build trust at a time when most fintechs can’t afford to.

Revenue insulation

Although transaction volumes are down, banking fintechs can still harness revenues elsewhere.

Starling continues to earn a commission from its marketplace and business offering, which has continued to grow at around 450-500 new small and medium-sized enterprise (SME) clients per day, according to a spokesperson.

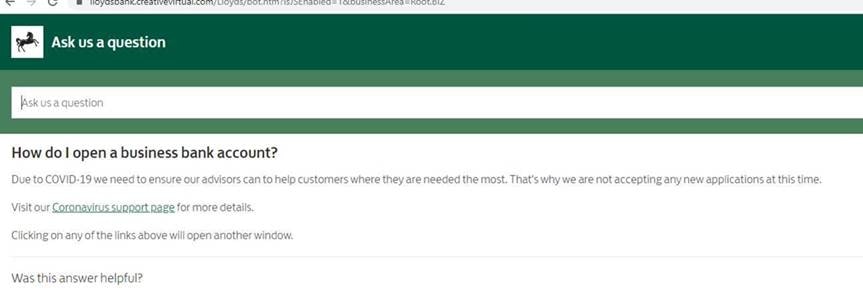

This comes amid a rise in self-employment and traditional players' struggles in the SME sector: Lloyds is no longer taking new business accounts and RBS cannot onboard business customers remotely.

As a result, SME banking apps should see better acquisition rates than their consumer-facing peers. Indeed, Cashplus — which offers premium, online business accounts — said it saw a 10% increase in growth in March. Meanwhile, France's Qonto said download growth was only a "bit lower" last month.

Meanwhile, Revolut can leverage its trading platform, which should help balance a downturn in its FX services. Its international offering may also see them recover sooner, serving areas where lockdown could be lifted imminently alongside N26.

Elsewhere, Spain's BNext said the lockdown had encouraged it to fast-track its premium offering by six months. Its new features include access to digital doctors and loyalty packages, helping maximise domestic revenues in the absence of travel.

"We've spent a lot of time wanting to do this but it took a back seat [to travel features]," Alfonso Sainz de Baranda, BNext's chief growth officer, told Sifted. "So now there's been a tech pivot."

He added the company has pushed back plans for its Series B by cutting marketing costs by nearly 100% and halted its expansion plans.

Meanwhile, Monzo is looking to bolster its lending book to help consumers access loans.

* N26 and Revolut, which operate internationally, have also seen a decrease in growth across downloads in Italy, the Netherlands, Spain and Sweden.