A long, long time ago — also known as February — venture capital investor Matthew Bradley coined the term ‘marketing advance’ to describe how new lending platforms are disrupting venture capital models. These platforms give fast, flexible access to funds for marketing campaigns without the pressures of taking on new investors. For marketing heavy scaleups, notably direct-to-consumer businesses, it’s an enticing idea.

For years, VCs have been flooding companies with cash to scale fast and keep competition out. Many did so by investing in marketing to reach new customers fast, but the effectiveness of Facebook and Google ads began running thin as everyone adopted the same strategy. The subsequent failure rate of scaleups and below-average returns for VCs calls for new approaches.

So what is the best way to use marketing to go from startup to scaleup, especially now? And what’s the best way to fund that growth?

Creativity in exchange for equity

Enter ‘creative capital’. Here, creative, marketing and design companies become investors in early-stage ventures helping imagine, develop and launch their brands from scratch in return for equity.

Originally, new companies would pay huge sums for blockbuster ads to ‘build the brand’ — that’s how Apple and Nike became famous. Likewise, through sustained, long-term investment in traditional media, P&G has built up more brands with multi-unicorn valuations than any notable VC has.

The direct-to-consumer boom of the last decade shifted how brands were brought to market and scaled at speed. Alongside the initial Facebook and Google-ad boom, Midas touch branding companies like Red Antler and Gin Lane developed highly investable brands using a hybrid model of fees and equity. They even developed their own side-car funds investing hard capital too.

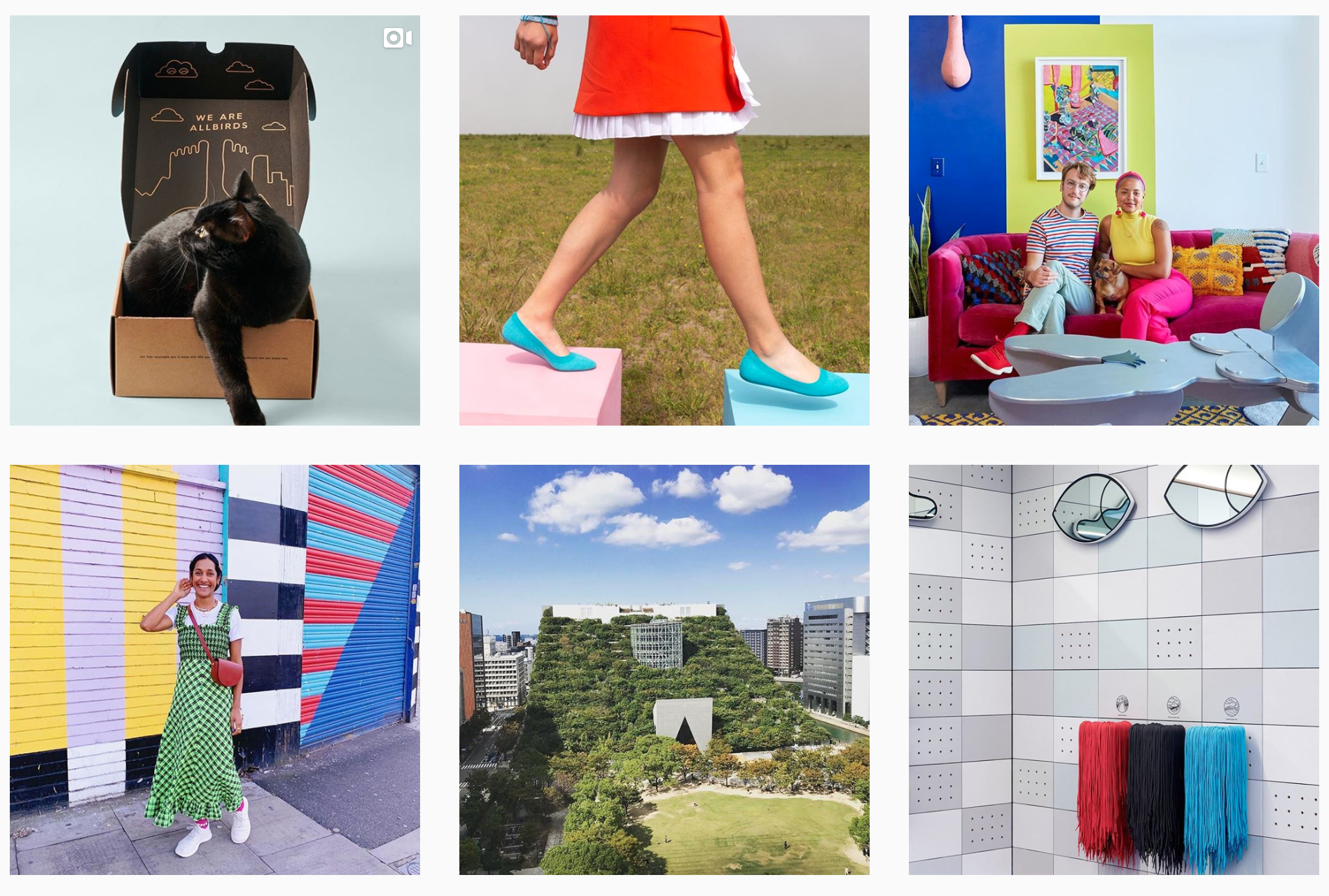

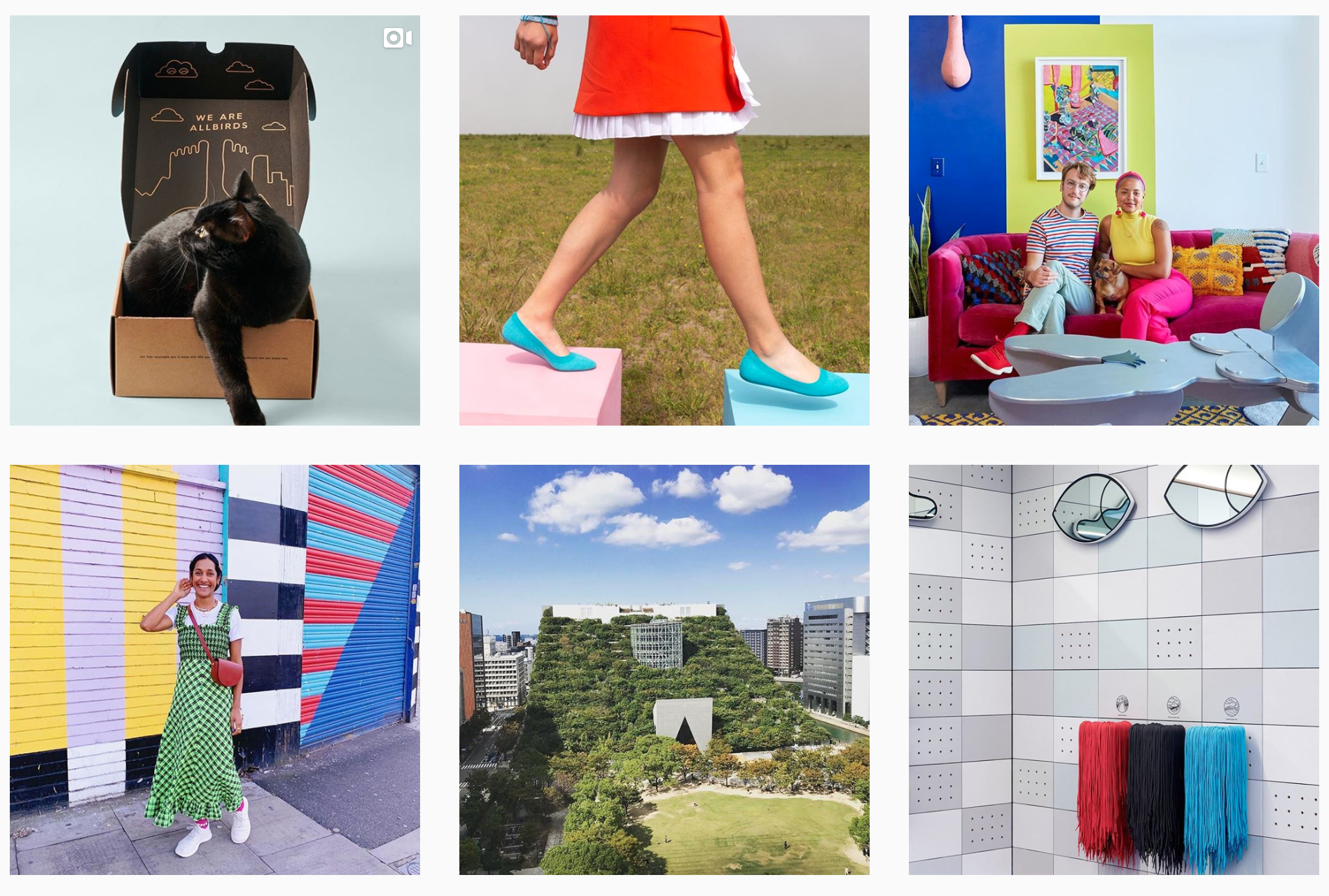

It gave rise to an entire creative movement: the NYC-DTC brands. Among these, you’ll find Warby Parker, Casper, Allbirds, Harry’s and Hims. These brands have their own style, complete with quippy Instagram feeds, pastel gradients and Matisse cutouts. While a few failed, most went on to gain valuations of over a billion dollars — though perhaps not with the sustainable profits to boot.

Having a brand strategy, not just being ‘direct-to-consumer’

Back to today, every single brand in the world is now direct-to-consumer — and the new cycle of e-commerce has begun faster than you can say ‘unprecedented’. Even the expression ‘DTC’ seems increasingly redundant.

If we know one thing, it’s that the fastest new risers in the post-Covid era will take their investor pitch deck and immediately hold a brand mirror up to it. Analyst and brand specialist Ana Andjelic summarises it well when she asks whether VCs see their investments as assets or brands. Her case is clear: beyond world-beating tech, brands and only brands deliver bigger, sustainable returns.

The fastest new risers in the post-Covid era will take their investor pitch deck and immediately hold a brand mirror up to it.

Great brands are not built through acquisition campaigns via Facebook and Google alone. Great brands obsess over their product difference such that they can organically attract a community towards it. Then they focus on scaling by being creatively distinctive (emotionally, not just rationally) and looking at wider audience reach through all channels, not just hyper-targeting digitally. Design is not the only thing (the previous generation of direct-to-consumer brands were accused of being too similar in style), but it’s an incredibly valuable tool. How a brand identity is uniquely expressed and cemented across different touch points is the difference between being seen and actually noticed.

The next wave will be insulated by creativity, not money.

VC term sheets have turned tough and seed investments are down. Things will also become harder for startups as the world opens back up and big advertisers re-enter the market, themselves having been forced to get their digital acts together.

New ventures need a distinctive brand to be baked into their idea as early as possible.

Through this lens, a bigger role for ‘creative capital’ makes a ton of sense. New ventures need a distinctive brand to be baked into their idea as early as possible, providing a significant creative asset that can be sweated from the start (not left as it often is to Series B or later, missing significant early-mover advantages). That’s how brands like Lululemon ultimately put a dent in mega-brands like Nike, with sales of over $3bn and a valuation of nearly $7bn (the second-highest rising brand value ahead of Instagram and behind Netflix).

In the ‘creative capital’ model, instead of paying upfront, startups can get the right unit economics by treating expertise as a ‘capital investment’ in exchange for equity. The formation of a highly motivated team, with brand expertise at the table, ready to move fast, also brings a huge advantage. Alongside flexible funding options for marketing campaigns (in a market where media costs are already lower than ever) the stage is set for the next wave of high-value brands to emerge.