Energy

Fusion in 10 years?

Equinor, the Norwegian oil company, and ENI Next, the Italian energy company’s cleantech VC arm, took part in the $84m series A round for Commonwealth Fusion Systems, a US startup working on commercialising fusion energy.

Fusion, with its promises of unlimited no-carbon energy has been something of a Holy Grail for the industry — and almost equally unattainable. Reactors still use more energy than they actually put out and the standing joke in the industry is that “fusion is always 40 years away”. CFS says it can get it working by the 2030s, though.

Financial services

End of cash

US-based digital payment processing company Marqeta, whose backers include CommerzVentures, raised $150m from a single, undisclosed investor, at a valuation of $4.3bn. Various media sources have reported the investor might be Capital Group.

Digital payments companies like Marqeta feature in the Sifted list of fintechs likely to do well post lockdoown, as many merchants switch away from using cash.

Pay-as-you-go insurance

CommerzVentures led the £15m series B funding round into By Miles, the UK insuretch company that provides flexible insurance for lower-mileage drivers. As cars sit unused in driveways during lockdown, many more people are questioning old-school insurance models. Jaguar Land Rover’s investment arm InMotion Ventures is also an investor in the company.

Self-employed stability

BBVA and Anthemis, the startup creation studio, have launched Wollit, a startup that helps guarantee a stable income for self-employed people every month. Some 14m workers in the UK don’t know how much they will earn each month. Wollit guarantees workers a minimum sum each month, without interest, which they can pay back when their income goes back above that threshold.

UBS venture fund

Swiss bank UBS is reported to be starting a venture capital fund that will invest $10m-$20m in dozens of fintech companies.

SME loans

Santander Innoventures invested in a55, a Latin American startup offering loans to small businesses.

Healthcare

Telehealth still raking in investment

Two Swedish banks, Carnegie and Handelsbanken, and the health and wellbeing company Oriola Corporation took part in the €45m series C funding round for Doktor.se, a Swedish startup that offers digital health consultations through a smartphone app.

Doktor.se, which offers the service mainly in Sweden at the moment, plans to launch in four major markets in the next year.

Meanwhile, Philips Health Technology Ventures was one of the participants in the $16.7m series C funding round for Bright.md, the US-based telehealth service.

Like many telehealth providers, Bright has seen a huge surge in use since the Covid-19 pandemic and says it has supported 100,00 coronavirus related healthcare visits. The company says it can automate 90% of primary and urgent care visits.

Autoimmune treatments

Sanofi Ventures took part in the $46m series A funding round for Q32 Bio, a US biotech company developing treatments for patients with severe autoimmune and inflammatory disease.

Respiratory infections

Scottish Investment Bank took part in a £4m funding round for Pneumagen, a Scottish biotech startup developing a treatment for respiratory tract infections, including those caused by Covid-19

AI drug discovery

Novo Holdings became a new investor in Exscientia, as the UK startup that uses AI to speed up drug discovery raised a $60m Series C financing round. Exscientia is on the cusp of interesting times, with its first AI-discovered drug entering human clinical trials in January and the company joining the hunt for treatments for coronavirus.

Bumper crop of IPOs

Swiss drugmaker Novartis is planning a $10m private placement to run alongside the IPO of Pliant, the US biotech developing a treatment for fibrosis. Expectations for the IPO have been rising — it now hopes to raise as much as $110.4m — as other recently listed life sciences companies have seen their shares rise sharply. There are now 3 biotech companies planning to list in June.

Logistics

€25m Milkround

Poste Italiane invested in the €25m third funding round for Milkman Deliveries, a Milan-based startup offering last-mile delivery options for e-commerce orders. Poste Italiane and Milkman will also collaborate on creating a premium service for Poste customers. Milkman currently operates in just Milan, Turin and Rome, but is planning to expand internationally.

Retail

Computer vision

Zurich-based startup Scandit, which uses computer vision to scan barcodes, raised a $80m series-C funding round with Swisscom Ventures and NGP Capital participating.

Security

Blurring faces

Axa Venture Partners was the lead investor in the $13.5m funding round for D-ID, an Israeli startup developing technology that can mask and blur faces, anonymising images and video.

In an era where Covid-19 is ramping up surveillance, de-identification tech like this will increasingly be in demand, the company believes. Automakers who want to film drivers for their driver monitoring services — without fear of accidentally releasing publicly identifying information — are among those interested.

Telecoms

Cloud calls

Cloud-based phone systems, ideal for helping businesses transition to remote working, are another coronavirus winner, so it was not surprising to see Paris-based Aircall pull in a €59.2m series C round. Swisscom joined as a new investor. Aircall has 5000 customers globally, including Natwest, Spareroom and Glovo.

Who's hiring?

Program & product director, Haigo (Agency), Paris

International product manager (Android), consumer operations, Google, London

Innovation manager, Plan International, Woking

Senior innovation manager, Deutsche Kredibank, Berlin

Digital innovation scout, Provinzial Rheinland Versicherung, Dusseldorf

Good reads

AI isn’t magical and it won’t help you reopen your business

AI is not having a good pandemic. It has been criticised for not predicting or helping manage coronavirus. Now, according to this Wall Street Journal article, it turns out that many companies are furloughing their once-precious data scientists — a sign that scepticism about AI is growing.

Uber, for example, has closed down its AI research lab and Airbnb has let go some 29 data scientists. Hiring for these roles is down 50% since before the pandemic.

It’s not the end of the road for AI, just a readjustment. The pandemic is showing a lot of companies more clearly what AI can and can’t do. It is great at taking over some routine tasks from people, but is proving brittle in the face of sweeping changes to circumstances.

Will coronavirus make flying more expensive?

In the short-term, no, this BBC article concludes. In the medium-term, maybe.

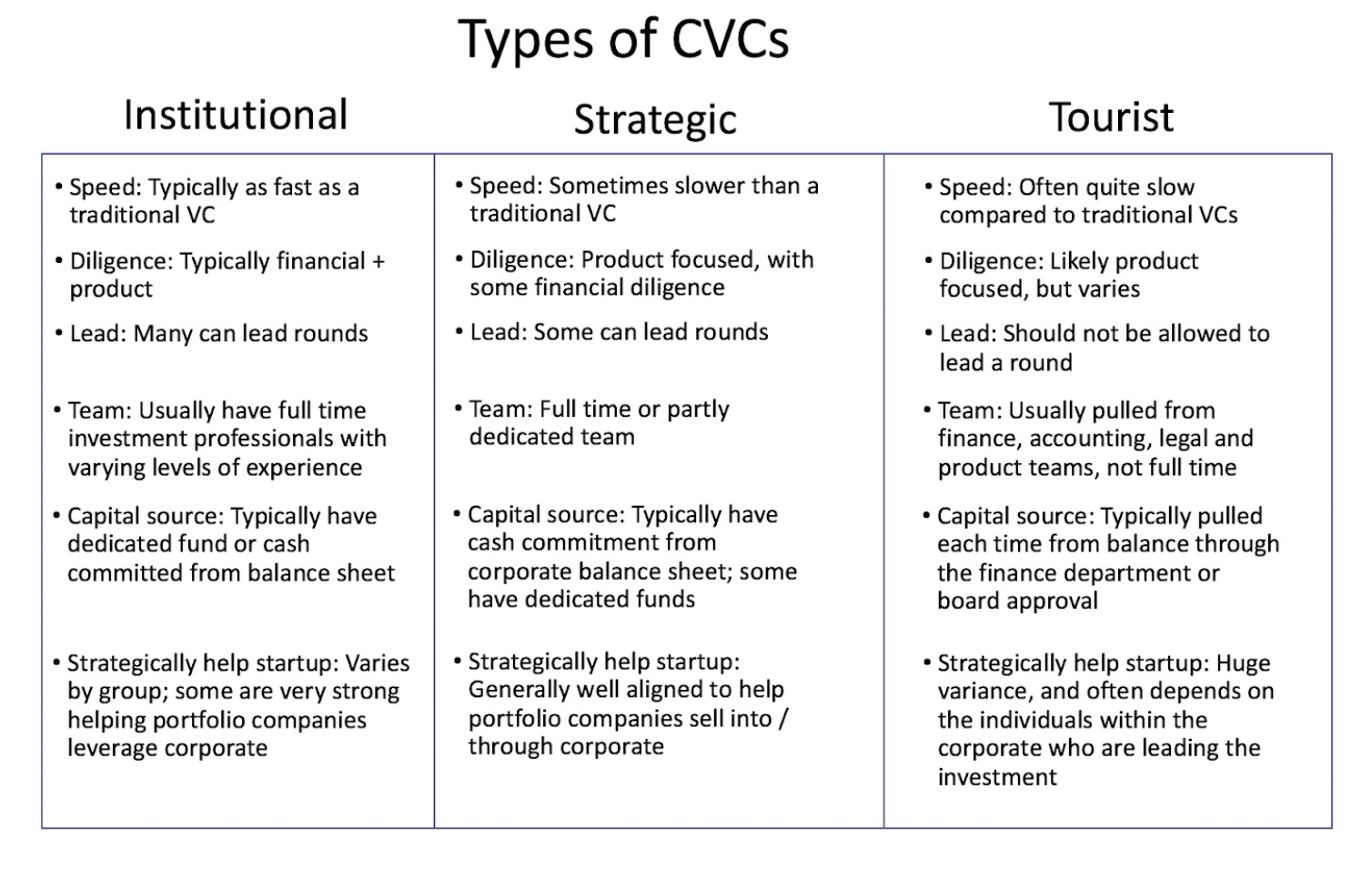

How to approach and work with the three different types of CVC investor

Corporate investment funds come in three flavours: institutional, strategic and tourist. This Techcrunch article gives a guide to dealing with each.

Institutional funds are looking mainly for returns and can be as fast as traditional VCs in making decisions. Strategic investors are slower and more product-focused.

Not every CVC investor is upfront about which category they fall into, so ask questions about whether the venture arm is autonomous or not and whether the partners have carry in the deals in order to find out which kind you are dealing with. Try not to deal with tourists at all.