One of the best parts of the annual Corporate Startup Stars Awards is sitting down with the heads of innovation from the world’s 50 most innovative companies and asking them about their plans. It is great insight into what is and isn’t working in the world of open innovation.

This is what we learnt this year (there is a more comprehensive report, here if you want more detail).

Innovation budgets are going up in 2022

Innovation budgets took a hit in 2021, with 20% of even the corporate startup stars — the companies with the most advanced innovation programmes — cutting their spending. In 2022, only 7% are planning cuts.

Some 43% will increase their innovation budget (compared to 37% in 2021), while half plan to maintain the same level of spending (in comparison to 43% in 2021).

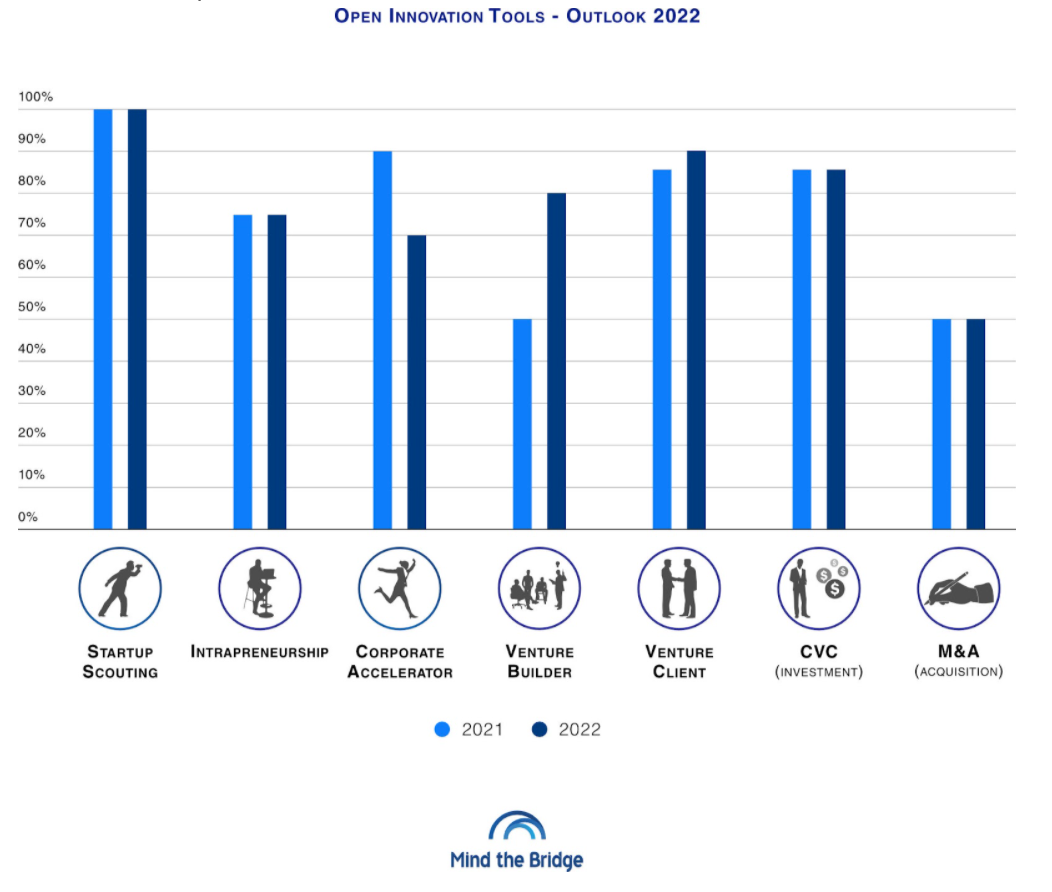

Venture builders are in the spotlight

There is a shift in focus from accelerator programmes to venture building. Many corporates are abandoning or downsizing their startup accelerators, while there is growing adoption of venture builders and studios.

Venture client and corporate venture funds continue to be the predominant mode of corporate-startup engagement. Intrapreneurship is generally widespread, although many programmes are struggling to produce results. Startup M&A remains more of an occasional activity (at least for European companies), rather than a structured path of action.

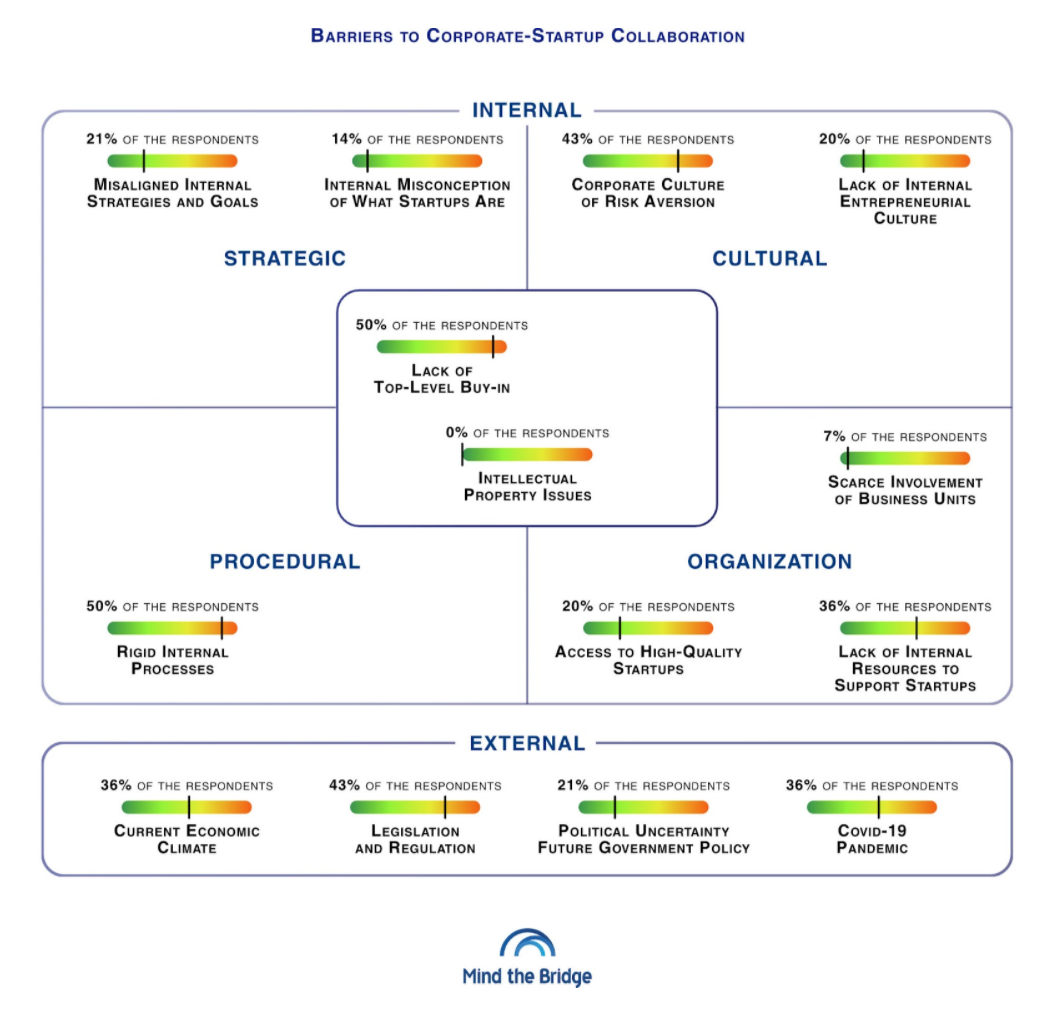

The main barriers to startup-corporate collaboration are internal

None of the corporate innovators we spoke to felt that the pandemic, or other external factors like economic and political uncertainty, would impact their plans for open innovation. While some worried about the possible effects of new regulation and legislation for most, the main concerns are internal.

While innovation leaders have been successful in getting business units across their companies involved with open innovation and startups (93% reported this to be the case), they are still being hampered by rigid internal processes and lack of resources (innovation teams are still small). Some 43% of respondents said a corporate culture of risk aversion was the main cultural barrier to innovation.

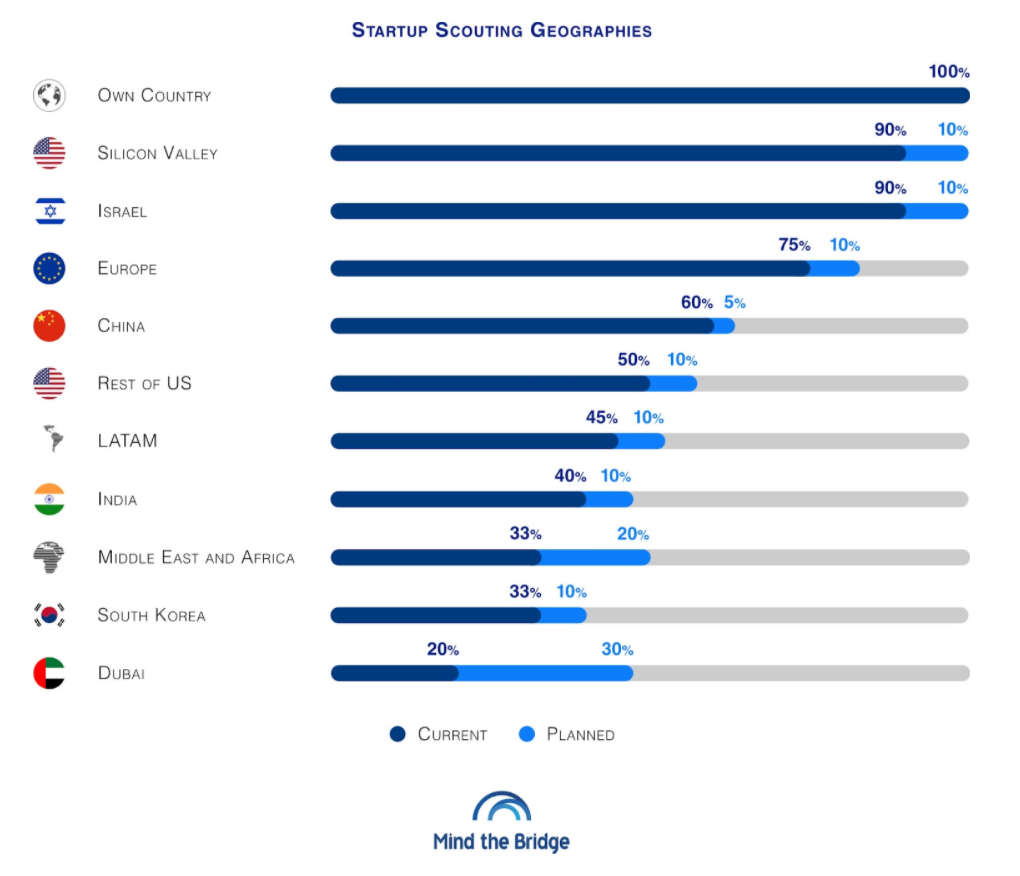

Where do the top companies look for innovation?

Silicon Valley and Israel are still top of the list for where companies go to search for innovation. Some 90% of the companies we spoke to are already active in these regions and the remaining 10% are planning to be in the near future. 75% scout for startups in Europe and 60% scout in China.

Latin America and India are less popular, with just 50% of companies actively scouting for startups there, and only one-third scout in the Middle East and Africa. South Korea and Dubai have recently emerged as countries that innovation leaders are interested in — they have not been mentioned in previous surveys.

What are the main tech challenges?

No surprises here. Sustainability, including climate and green energy, is almost universally mentioned as a focus area.

AI and mobility are also hot topics, followed by cybersecurity and agritech.

The Mind the Bridge’s report “Open Innovation Outlook 2022. Macro-Trends for 2022 in Corporate-Startup Engagement” is available for download here. The analysis represents the views of a limited number of innovation leaders, the Corporate Startup Stars. Therefore the evidence might not necessarily apply to companies that have just entered the open innovation arena.

Alberto Onetti is chair of Mind the Bridge.