In the fight against climate change, harnessing alternative materials to produce less polluting products is crucial.

While chemical crop protection products have a minimal impact on the massive Greenhouse Gas (GHG) emissions caused by the global food production system, their use has worsened the quality of soil, and been linked to a loss of biodiversity in Europe.

Solutions to these issues require innovative companies to navigate the common issues that have stymied widespread adoption of more sustainable alternatives. This year’s New Energy Challenge (NEC), an annual competition that connects startups in the energy sector to stakeholders that can expedite the decarbonisation of consumption, has found some of them.

Turning waste into biofuel

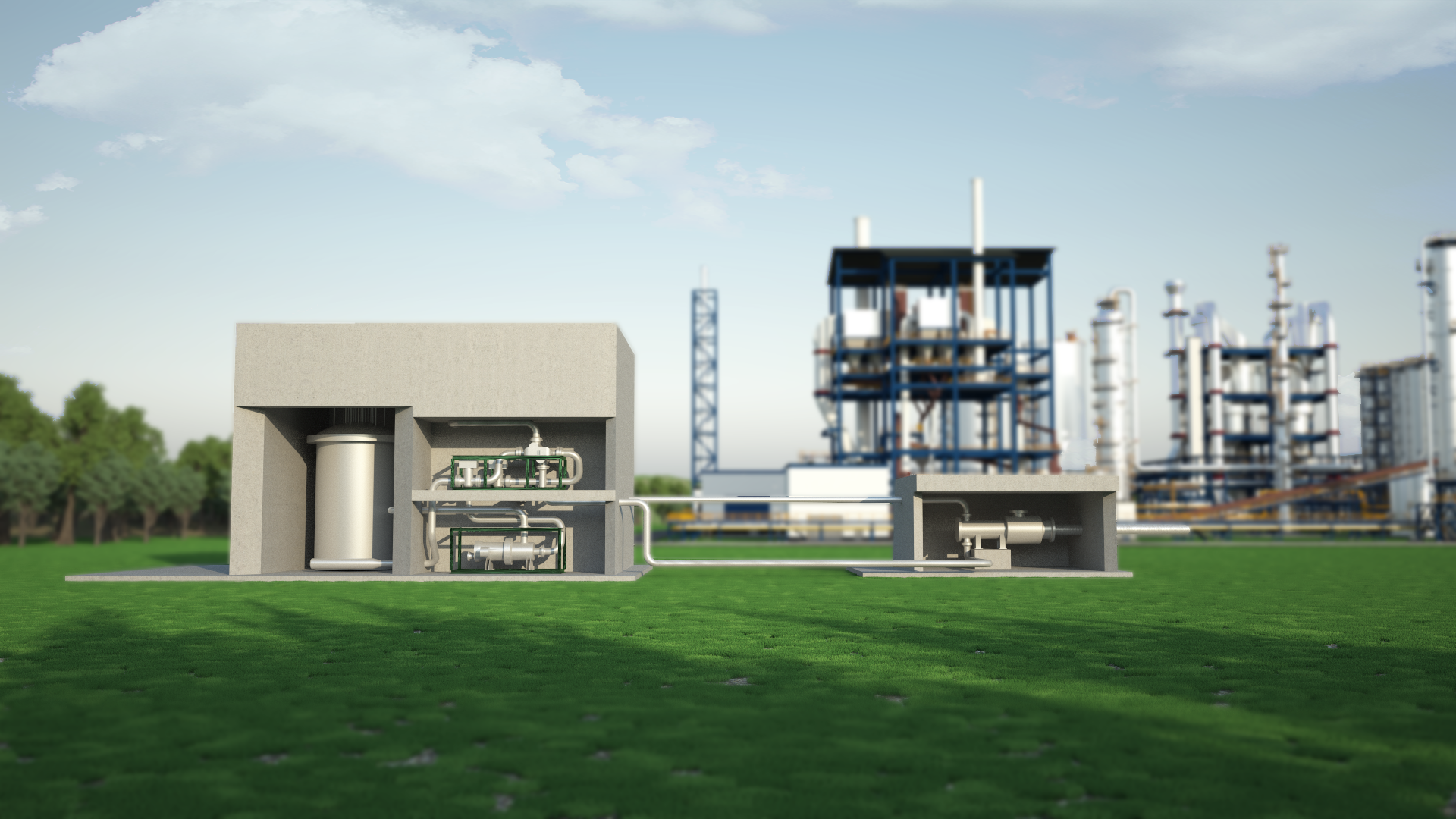

Terrawaste, a startup based in Rotterdam and a NEC finalist, uses its proprietary thermochemical conversion technology ‘htloop’ to convert carbon-based waste such as plastic, wood or agricultural waste into a biofuel.

It’s basically a biomimicry of what Mother Earth does in 10 million years, but we can do it in 40-45 minutes.

“The process is called hydrothermal liquefaction,” says Kristaps Cirulis, Terrawaste’s cofounder and chief marketing officer. “It’s basically a biomimicry of what Mother Earth does in 10 million years, but we can do it in 40-45 minutes.”

Cirulis explains that a similar process called pyrolysis has long existed. However, this method requires the stock material to be dried before it can be recycled, increasing production time and increasing energy use.

“Our main advantage is that we are pollution free, we have zero emissions. We don’t create any waste, and have a very high yield compared to other technologies. Secondly, we can take any number of waste materials and convert them back into value,” says Cirulis.

Changing up agriculture

In agriculture, farmers have remained wedded to chemical products thanks in part to their reliability compared to more environmentally friendly products, says Jamie Bacher, CEO and founder of Boost Biomes, a biotech based in the US and another NEC finalist.

“The goal of biologicals is to take some living product, some living microorganism as a product and use it on a field or in the soil,” says Bacher. “Historically, they tend to not be as reliable and not as effective as farmers would like.”

Boost Biomes technology looks to address this issue by identifying microbes that can work in tandem, and be tailored to different growing locations.

“The industry has been taking a microorganism, adding it into a complex ecosystem, and hoping and expecting that it does exactly what it's supposed to do every time in every location on every crop, regardless of the type of soil and the type and the location and the climate and so on. And that's just not how ecology works,” says Bacher.

“Boost has developed technology to understand those ecosystem interactions. We use that understanding, [so] that we can develop advanced biologicals that leverage those interactions, rather than get harmed by them.”

Challenges in scaling

Bacher says Boost has been able to produce a range of products which offer massive potential in creating a more sustainable agriculture industry.

The company is researching the potential for microbial products to reduce soil emissions by producing nitrogen as a by-product of crop growth, rather than the damaging nitrous oxide which is 300 times more potent than CO2.

In general, investors now are quite a bit slower, they’re doing their due diligence and not giving their money to anyone that’s coming in.

Meanwhile, it has also entered into a partnership with Japanese crop product company Nihon Nohyaku to produce novel bio-insecticides, and is also awaiting EPA approval to release its first product in the US, a biofungicide which protects grapes.

“Commercially, it can be a challenge to find the right partners,” says Bacher. “We work with Nihon, and a global crop nutrition company called Yara. We couldn’t ask for better partners. We've been able to lean on them.”

While Boost Biomes has been able to navigate partnerships and regulations, this is often the undoing of startups in the agriculture sector, says Mark Durno, managing partner for AgriFood at the Dutch accelerator-VC firm Rockstart, which organises NEC.

“Innovation in the AgriFood sector faces regulatory hurdles within a very complex, and oftentimes siloed, supply chain. It can be hard for innovators to gain access to the right partners,” he says. "Farmers are naturally wary of new applications; many will only have one opportunity per year to get it right in the field. Hesitation is especially true when promises cannot always be met in the early stages of innovation. This creates long lead times to commercialisation and (importantly!) scaling, with startups needing to deliver a high burden of proof to convince customers to switch to new approaches."

Durno says struggles with regulation is also often a concern for companies looking to improve recycling as it can place a burden on a company’s ability to scale.

“Scaling in the recycling sector confronts considerable obstacles: infrastructure development, widespread adoption of recycling practices and optimising existing packaging and recycling processes,” he says. “Startups often struggle with securing consistent access to raw materials, ensuring cost-effective operations and meeting regulatory standards.”

Terrawaste is planning to raise a Series A round of $4 million in the coming year, says Cirulis, having secured pre-seed funding last year. This capital will be used for the company’s first semi-industrial plant, which should have the capability to produce 100 litres of oil per hour. However Cirulis says the economic landscape could be a stumbling block.

“We’re a large capex type of investment,” he says. “It’s a long-term proposition, our returns won’t come in a year or two.

“In general, investors now are quite a bit slower, they’re doing their due diligence and not giving their money to anyone that’s coming in,” he continues. That takes a lot of time and effort for us. From a climate point of view, that’s sad, because we could accelerate and deploy the solution much faster if we have the budget.”

The circular economy

Nevertheless, Cirulis maintains there is a massive opportunity for investors to capitalise on the coming demand for recycled products.

Startups, investors, regulators and politicians all play a pivotal role in propelling the economy towards circularity.

“If you look at the data, we estimate that globally our industry will only be able to provide 35% of the demand for recycled and sustainable materials. That’s a 70% gap which we can’t solve with just mechanical recycling,” he says.

Bacher is similarly bullish about the potential for growth in the agrifood market. He reports that by the end of the decade, there will be a $12bn market for bio fertilisers and biological crop protection products.

“Consumers are making choices at the grocery store,” he says. “We want a couple of things besides fresh and good tasting food. We want food that has reduced the use of chemistry in the system.”

But that sentiment will be needed from many different stakeholders, if the wider economy is to embrace the concept of circularity, and become more sustainable.

“Startups, investors, regulators and politicians all play a pivotal role in propelling the economy towards circularity,” says Durno.

He points towards the example set by the local government in Amsterdam as an example for other lawmakers. The city has promised to halve its new raw material use by 2030, and to achieve circularity by 2050.

Cirulis agrees that only through such policies — and the collaboration between forces within the economy — can companies offering novel new solutions actually make the difference.

“If we look from a Terrawaste point of view, we clearly understand we are not the silver bullet. Without collaboration we won’t achieve any of our goals.”